What is a pay advance app?

Pay advance apps like Wagetap have grown rapidly in Australia despite their recent arrival on the financial services scene. This service allows people who live paycheque to paycheque to access their pay early, albeit for a fee. This article explains how wage advance apps like Wagetap work, how to sign up for them, and how they can benefit you.

Here are Things You Should Know About Pay Advance Apps

Wagetap and other pay advance apps allow users to borrow up to a certain percentage of their salary before they are paid. They give you immediate access to your paycheque before your payday. Pay advance apps can also be called wage advance and cash advance apps.How Do Wage Advance Apps Work?

The Steps for Using a Pay Advance are as follows:

- • Download the app and create an account.

- • The app calculates the amount of money you can withdraw based on your income and other factors.

- • You then choose the amount you'd like to take out.

- • For repayments, your account will be automatically debited on your next payday.

Pay Advance Apps Offer Certain Features.

Each wage advance app has different features and fees, but they are alike in some ways.- • Pay advance apps usually charge a flat fee of 5% per transaction, which makes them cheaper than most other short-term loans, provided repayments are made on time.

- • Most providers provide you with money on the same day you request it, and the transfer is usually completed within minutes.

- • The borrowed money is automatically deducted from your bank account on your next payday.

How to Apply for Pay-on-demand Service

It's easy to use pay-on-demand services in Australia. Choose an app like Wagetap and sign up. After registering, provide a valid ID and relevant information about your online bank account so that service providers can access your revenue information. You can then apply for a wage advance as soon as you activate your account and have it verified. The money will be deposited into your nominated account immediately.Other Important Things You Need to Know

Several reasons why your loan might be denied

You may be denied a cash advance for various reasons. Here are three examples:- • You requested more money than you are permitted to obtain in advance. Some apps provide up to 25% of your salary, while others offer a set amount ranging from $100 to $2,000. Be sure to investigate the terms of each app prior to applying for a pay advance.

- • Individuals who are self-employed or who do not receive a regular income may not be eligible for pay-on-demand services.

- • You requested to be paid in a Savings account. Most apps deposit the amount advanced into a transaction bank account. Because of restrictions imposed by banks, savings accounts are not available.

It is not possible to cash out more than the approved credit limit based on your income

You cannot withdraw more than your paycheque through a paycheque advance app. With credit card cash advances, you may exceed your credit card cash advance limit and pay higher interest rates or over-the-limit charges.Pay advance apps are convenient because they are done digitally

Pay advance apps like Wagetap allow you access to your money immediately. You can apply in under two minutes, check your eligibility, and get instant approval.The Conclusion

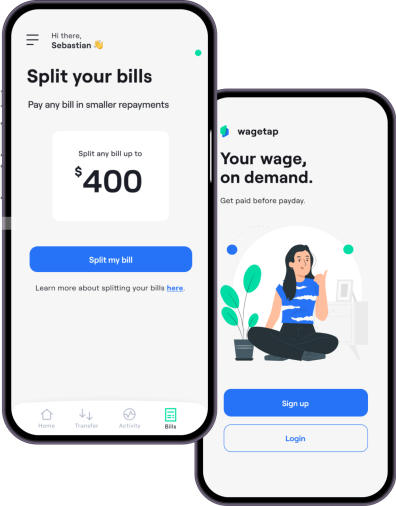

For additional help, you can always download Wagetap. It is a leading wage advance and bill split app that allows you to access your pay early. Emergencies can always happen and Wagetap can help you handle life's unexpected expenses.

For additional help in improving your spending habits, you can always download Wagetap. It is a leading wage advance and bill split app that allows you to access your pay early. Emergencies can always happen and Wagetap can help you handle life's unexpected expenses.

Share this post

Download Wagetap today

Get your Pay On demand with Wagetap

Subscribe to our Newsletter

© 2025 Wagetap All rights reserved

Digital Services Australia V Pty Ltd