Payday Loan vs. Wage Advance

If you’re in need of readily available funds to cover an unexpected expense or help tie you over, you need to choose between a Payday Loan and a Wage Advance. This article breaks down the differences between them and explains how they both work so you can make an informed choice.

Differences Between a Payday Loan and a Wage Advance

| Feature | Wage Advance | Payday Loan |

| Definition | A portion of an employee's earned wages paid before the regular payday. | A short-term, high-interest loan, typically due on the borrower's next payday. |

| Source of Funds | Provided by the employer as an employee benefit. | Offered by payday lenders or online lending platforms. |

| Cost/Interest Rates | Generally interest-free or with minimal fees, as it's a prepayment of earned wages. | Typically comes with high interest rates, leading to a higher cost for the borrower. |

| Repayment Structure | Deducted from the employee's future paycheques. | Usually due in a lump sum on the borrower's next payday, often within 14-30 days. |

| Credit Check | No or minimal credit check, as it's based on the employee's earnings. | Often involves a credit check, and approval is based on the borrower's creditworthiness. |

| Availability | Limited to employees and contingent upon employer policies. | Widely available to individuals with a regular income, regardless of employment status. |

| Regulation | Subject to employment and labour laws, may vary by jurisdiction. | Regulated by financial authorities and subject to state and federal laws. |

| Risk of Debt Cycle | Generally lower risk, as it's a portion of the individual's own earnings. | Higher risk due to the short-term nature and high costs, potentially leading to a debt cycle. |

| Purpose | Primarily used for financial emergencies or unexpected expenses. | Typically used for short-term financial needs, often when the borrower is facing a cash shortfall. |

How Payday Loans Work

Payday loans, formally known as SACC loans (Small Amount Credit Contract Loans) are limited in how much they offer - the maximum limit is usually $2000 - but the costs can rack up. A 20% establishment fee and a monthly fee of 4% are typically charged. This means that if you take out a loan of $2000 you will be required to pay an additional $400 as well as another $80 every month until you have paid back the loan in full. And if you default on your repayment you are liable to incur extra fees that indenture you further. (If you’re looking to borrow more than $2,000, Medium Amount Credit Contract loans are an option, but the same risks apply to a greater extent).How Wage Advances Work

What are the Repayment Terms?

Payday loans have repayment periods between 16 days and one year. Be careful because some payday lenders specify minimum repayment terms of up to 6 months to make you pay more fees than necessary.With a pay advance from Wagetap, your advance is due to be repaid on the date of your next payday. You also have options to delay your repayment to your next payday or another date that suits you. With Wagetap, you can also split your repayment into smaller amounts and pay over multiple paydays. The best part is that these options are entirely free.What are the Eligibility Requirements?

Which One is Right for Me?

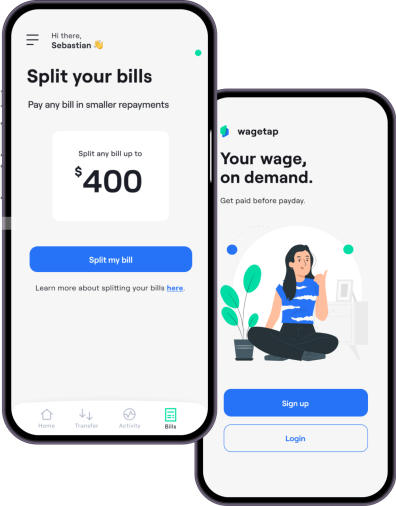

Download Wagetap to Get Started

App Store

Google Play

For additional help in improving your spending habits, you can always download Wagetap. It is a leading wage advance and bill split app that allows you to access your pay early. Emergencies can always happen and Wagetap can help you handle life's unexpected expenses.

Share this post

Download Wagetap today

Get your Pay On demand with Wagetap

Subscribe to our Newsletter

© 2025 Wagetap All rights reserved

Digital Services Australia V Pty Ltd