Electricity Bill

Relieve the Stress of Unexpected Electricity Bills

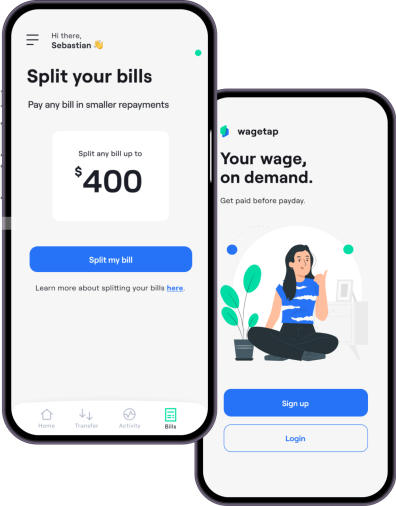

Pay your bill today and split the cost into instalments and avoid any late fees.

Fast Cash or Split Your Bill into 4 Equal Payments with Our App

Paying the electric bill is a hassle, but it has to be done. Missing a payment can lead to late fees or, even worse, your electricity being shut off. That’s where Wagetap comes in. You can get a wage cash advance or easily pay your electricity bill on the spot with our bill split features. All you have to do is pay us back in three to four equal payments when payday comes around. Ready to make sure you can always pay your electricity bill on time? Download Wagetap today!

Get Started with Wagetap

How it Works

Two Ways We Can Help:

Instant Cash to Pay Your Bill

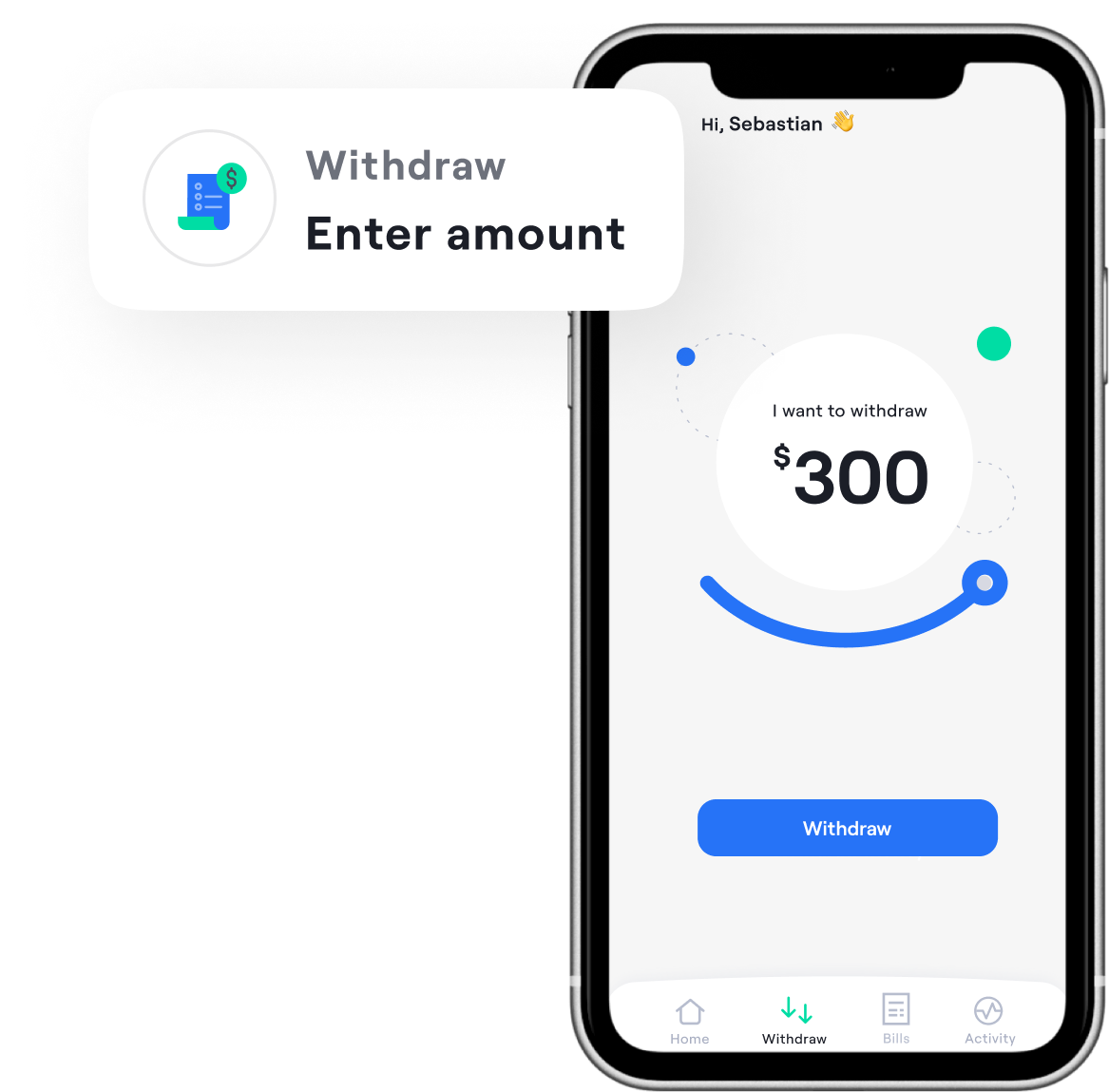

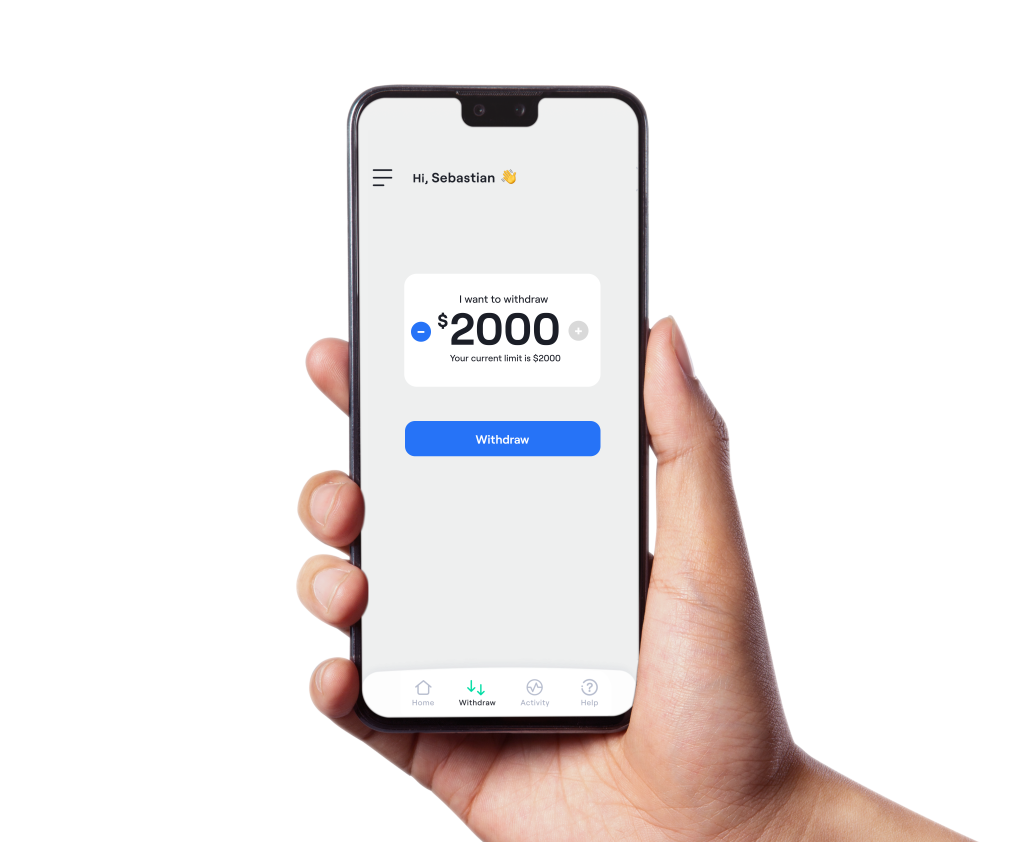

When you use Wagetap to pay your bill, the amount will be covered instantly. You won’t have to pay a late fee or worry about missing any payments. You can also get up to $2,000 early with our wage advance if you’d prefer, letting you spend your money on your bills how you want to. You can even cover your bill on the same day. Just set your bill pay reminder and call on Wagetap when you need a little extra help.

Spread the Cost of Your Utilities into a Stress-free Payment Plan

With Wagetap, you can spread out the cost of your electricity bill. Instead of losing a big chunk of money to pay your bill in full, you can make small payments each payday. This can give you the breathing room you need to manage your finances and get them under control.

Our stress-free payment plan won’t add any worries. Bills under $300 can be paid in three easy payments and bills over $300 can be paid over the course of four paydays. It’s simple, easy and hassle-free.

Power Bill Providers We Support

Wagetap supports almost all major power bill providers. You can cover bills through companies like AGL, Origin, Energy Australia and more. All you have to do is connect your Wagetap app with your bill provider and use the bill split feature. Your bill will be paid and we’ll set up your repayment plan for you.

Eligibility Requirements for Electric Bill Assistance

To take advantage of our bill split assistance, you will need to meet several eligibility requirements. If your circumstances change after being approved initially and you no longer meet our eligibility requirements, you may not have access to bill split anymore. However, you can also become eligible again if your status changes.

Here are the requirements that need to be met:

A connected account that allows direct debit transactions

A minimum income of $800/month

Wages paid by an employer payroll

Consistent wages on a weekly, fortnightly or monthly basis

You may also lose eligibility if:

More than 50% of your wage is from sources such as Centrelink and other government payments

You have too many gambling expenses

You have too many dishonour fees

You have too many payment reversals

Your recent expenses and repayment history have not passed our eligibility criteria.

Keep in mind that we reassess your eligibility regularly. Feel free to get in touch with us if you have questions about your eligibility.

Download Our App to Get Started!

Ready to get your bills under control with Wagetap? Once you’ve created your account and been verified, you can get instant access to our bill split features which cover up to $600 worth of bills. You can also take advantage of our wage advance feature, which provides you with up to $300 of your wage in advance. You can even use both features at the same time to get the money you need and cover your bills in a pinch. Download Wagetap today on the Apple App Store or Google Play Store! Take the stress out of bills and make things easier with our convenient features.

It’s Like Buy Now Pay Later But for Your Utility Bills

Our bill split features work similarly to buy now pay later features for shopping. With buy now pay later, you can cover shopping expenses and spread out payments at your favourite stores. With Wagetap, you can do the same thing with your utility bills. While it may not be as fun as buying a new pair of shoes, it will help you have less financial stress.

See why over 300k Australians love us

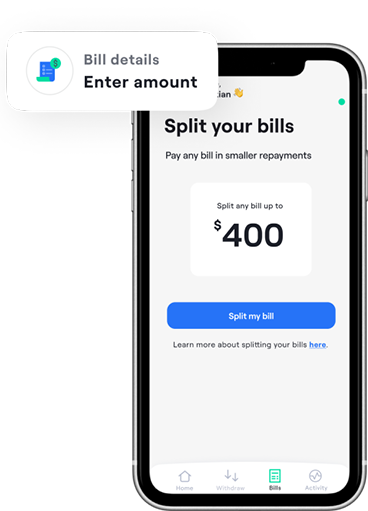

Bill Split

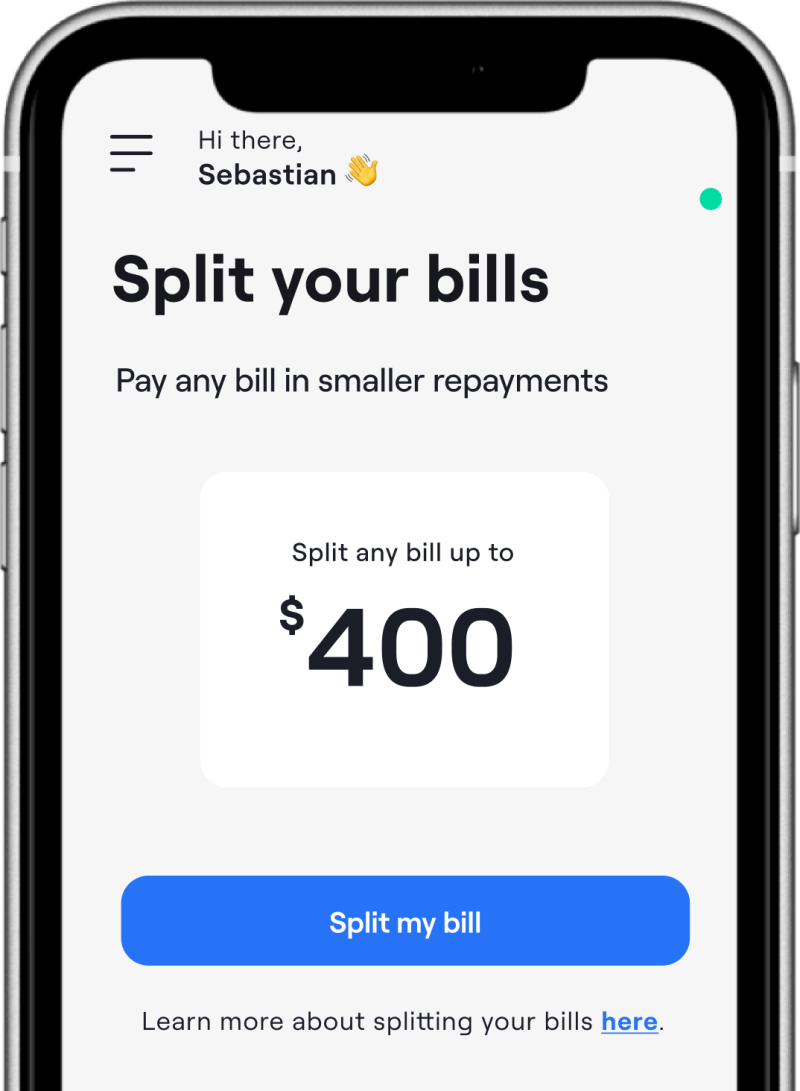

What is Bill Split?

How does Bill Split work?

- 1. Add a bill within your eligibility limit

- 2. We cover your bill for you

- 3. You make smaller repayments aligned to your payday.

How much does it cost to Bill Split?

How much of my bill can I pay with Wagetap?

What affects my eligibility to use Bill Split?

- • You have not connected a transacting account that your wages are deposited. (A transacting account is an account that allows direct debits. We need this so we can process repayments.)

- • You don't meet the minimum income requirement ($800/month)

- • Your wages are not paid by your employer's payroll (not as bank transfers).

- • Centrelink makes up more than 50% of your wages. (We also don't accept other government payments such as pension payments as wages)

- • Your wages are not consistent, meaning you aren't consistently paid weekly, fortnightly or monthly.

- • You have too many gambling expenses on your account.

- • You have too many dishonour fees on your account.

- • You have too many payment reversals on your account.

- • Your recent expenses and repayment history have not passed our eligibility criteria.

How long will it take for my bill to be paid?

How many split repayments will I need to make?

- • If your bill is less than $300, your bill will be split into 3 repayments.

- • If your bill is more than $300, your bill will be split into 4 repayments.

Can I use Bill Split and Wage Advance at the same time?

How many bills can I split at a time?

Will I get a receipt for my bill payment?

Why did the bill payment get rejected?

Wage Advance

How does wage advance work?

How often can I withdraw?

How much can I withdraw?

How much does it cost to make a withdrawal?

Can I get my funds instantly?

Why haven't I met the eligibility criteria?

- • You have not connected a transacting account that your wages are deposited into. (A transacting account is an account that allows direct debits. We need this so we can process repayments.)

- • You don't meet the minimum income requirement ($800/month)

- • Your wages are not paid by your employer's payroll (not as bank transfers).

- • Your Centrelink payments make up more than 50% of you wages. (We also don't accept other government payments such as pension payments as wages)

- • Your wages are not consistent, meaning you aren't consistently paid weekly, fortnightly or monthly.

- • You have too many gambling expenses on your account.

- • You have too many dishonour fees on your account.

- • You have too many payment reversals on your account.

- • Your recent expenses and repayment history have not passed our eligibility criteria.

I’ve made withdrawals before, why can’t I make another one?

How can I become eligible?

Download Wagetap today

Get your Pay On demand with Wagetap

Subscribe to our Newsletter

© 2024 Wagetap All rights reserved

Digital Services Australia V Pty Ltd