Get Fast Cash with Our App

Need help paying for day care? Wagetap is your solution. With Wagetap, you can get the money you’ve earned at work sooner. Our wage advance makes paying your child care bills on time more manageable. If you’re feeling the financial pressure of paying your bills each month, let Wagetap help. Download the Wagetap app today to get access to our fast cash features and read on to find out how our app works.

Get Started with Wagetap

Instant Cash to Pay for Childcare

Wagetap provides you with instant cash to pay for child care expenses.

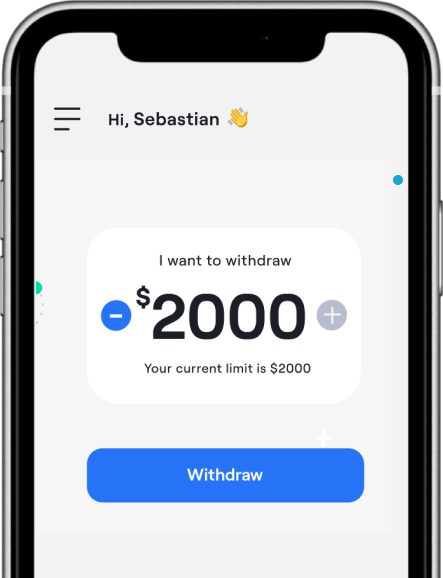

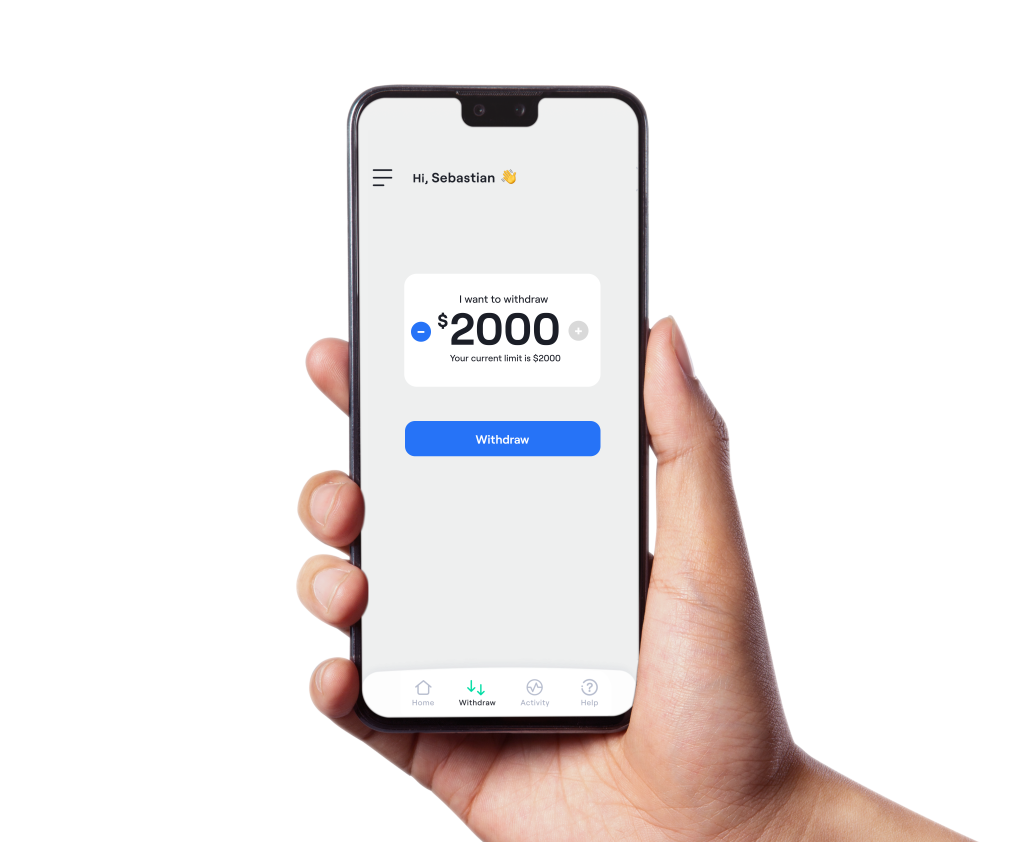

Our wage advance feature is perfect when you’re short on cash and need a little extra to get you through until payday. With wage advance, you can borrow up to $2,000 of your wage early. Waiting until payday isn’t always convenient, so why not request your money and pay the bills you need to pay? Wage advance doesn’t restrict what you spend your money on, so you can easily cover other bills and expenses with wage advance as needed. Cover groceries, emergencies and any other expenses that pop up.

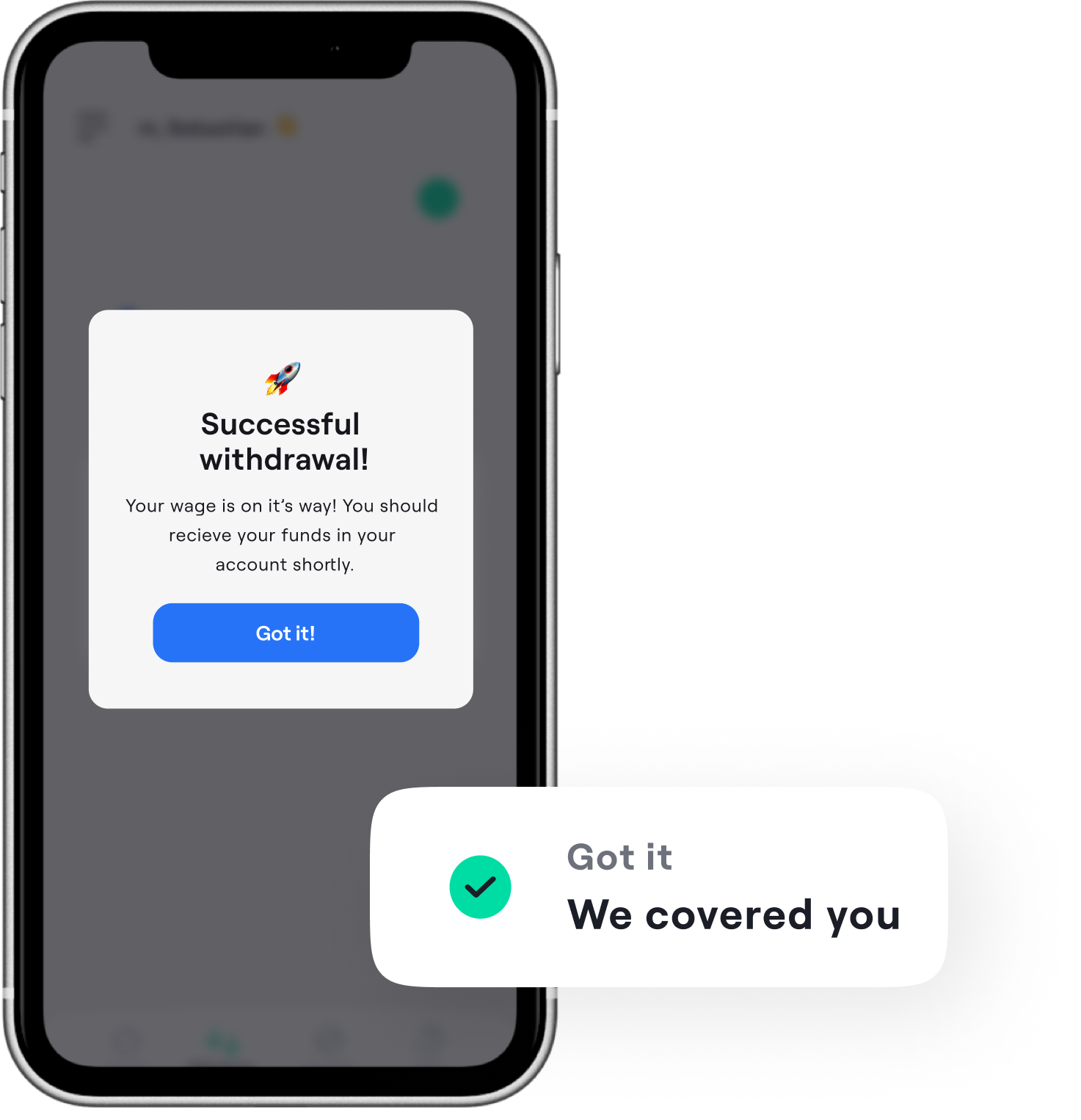

Once payday comes around, you’ll get the rest of your wage, and you won’t have to worry about paying any late fees.

3 Easy Steps to Access Your Wage

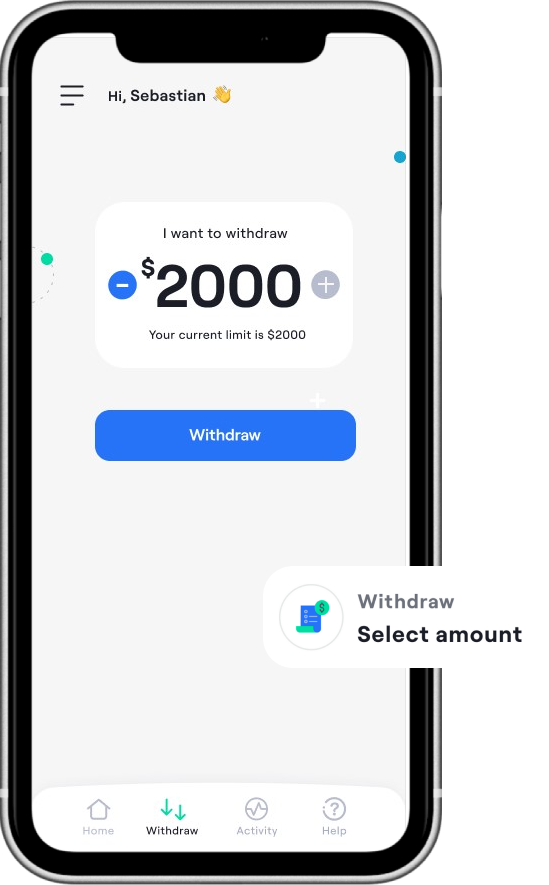

1. Visit your app store and download Wagetap today. You can find our app on the Apple App Store and the Google Play Store. Easily access your wages right from your phone.

2. We just need a few details to verify you, it’s fast and easy. Once you’re set up you get access to our convenient features. It’s that simple.

3. Access your pay instantly for just a small fee. You don’t have to wait to access your wages. Just pay us back when your next payday comes around.

Eligibility Requirements for Childcare Assistance

While we seek to make Wagetap as accessible as possible, certain eligibility requirements need to be met. Access to our cash advance features isn’t guaranteed, and you may lose eligibility if you no longer meet the base requirements. If you have any questions about your eligibility, please reach out to our support team.

Here are the requirements that need to be met to qualify for Wagetap’s child care assistance features:

A connected account that allows direct debit transactions

A minimum income of $800/month

Wages paid by an employer's payroll

Consistent wages on a weekly, fortnightly or monthly basis

You may also lose eligibility if:

More than 50% of your wage is from sources such as Centrelink and other government payments

You have too many gambling expenses

You have too many dishonour fees

You have too many payment reversals

Your recent expenses and repayment history have not passed our eligibility criteria

Please note that we reassess user eligibility regularly.

Download Our App to Get Started!

Do you want to make sure you’re never short on cash for child care bills? Wagetap can help you get your monthly bills under control. With our fast-cash features, you can get the money you need. After all, it’s the money you’ve earned. Why shouldn’t you have it when you need it most? We also offer a bill split feature. While this split bill feature isn’t available for child care and day care expenses, it can be used to break up some other common bills into smaller, more manageable payments. Make sure to check our site to see what bills can be covered with our split bill feature. Download Wagetap today on the Apple App Store or Google Play Store to get started! Signing up only takes a few minutes.

See why over 300k Australians love us

Wage Advance

How does wage advance work?

How often can I withdraw?

How much can I withdraw?

How much does it cost to make a withdrawal?

Can I get my funds instantly?

Why haven't I met the eligibility criteria?

- • You have not connected a transacting account that your wages are deposited into. (A transacting account is an account that allows direct debits. We need this so we can process repayments.)

- • You don't meet the minimum income requirement ($800/month)

- • Your wages are not paid by your employer's payroll (not as bank transfers).

- • Your Centrelink payments make up more than 50% of you wages. (We also don't accept other government payments such as pension payments as wages)

- • Your wages are not consistent, meaning you aren't consistently paid weekly, fortnightly or monthly.

- • You have too many gambling expenses on your account.

- • You have too many dishonour fees on your account.

- • You have too many payment reversals on your account.

- • Your recent expenses and repayment history have not passed our eligibility criteria.

I’ve made withdrawals before, why can’t I make another one?

How can I become eligible?

Download Wagetap today

Get your Pay On demand with Wagetap

Subscribe to our Newsletter

© 2024 Wagetap All rights reserved

Digital Services Australia V Pty Ltd