Basic Tips For Understanding Your Money Mindset and How To Improve It

Money can be a sensitive topic for many people because they are afraid to talk or think about it. Everyone has their own way of dealing with finances; some people are natural savers, while others love to splurge on the latest fashion trends. With that said, it is important to note that there is one thing that all successful people have in common: they understand their money mindset and work to improve it.

Here are Basic Tips For Understanding Your Money Mindset and How To Improve It

Improving your money mindset doesn’t happen overnight, but anyone can start on the right track. These essential tips will help you identify your current financial situation, set realistic goals, and take small steps toward a happier financial future.Know Your Current Financial Situation

Set Realistic Goals

Once you know your current financial situation, you can set realistic goals. Your goals should be specific, measurable, achievable, and have an actual deadline. Let's say you want to save $1,000 towards a vacation fund. A realistic goal would be to save $100 a month for six months, which would get you to $1,000.Now, you must save the right amount for the right goal. You should save enough for your vacation and put enough away for savings and emergencies. If you have trouble saving for a specific goal, plenty of ways to make money won't affect your money mindset. You can start a side hustle, research online jobs, or even take up a part-time job or internship. Setting realistic financial goals will help you stay on track and ensure you are hitting your spending goals.Staying realistic can also save you from frustration. Setting impossible goals can do more harm than good because they do not grant you anything. Instead of motivating you with your accomplishments, they diminish your spirit and can hinder your progress. Always be grounded in reality regarding your goals because the more attainable goals you achieve, the more motivation they grant you.Identify Where You Are Going Wrong

Don’t Be Afraid to Ask for Help

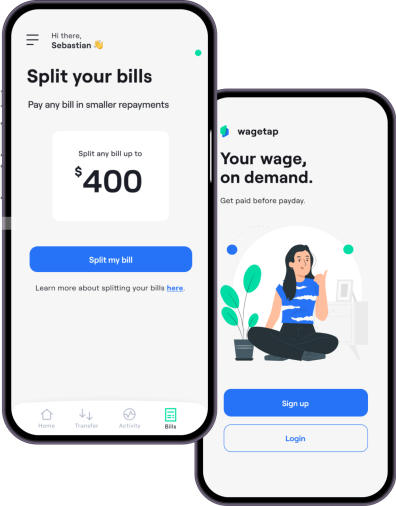

Finally, don't be afraid to ask for help. To improve your money mindset, you must be honest and accept that you might be doing it incorrectly. It would be best to talk to a financial advisor or bank to help you understand your current financial situation.In dire times, pride should not be your utmost priority but your eagerness to change and improve. Asking for help from people you trust can even be a gateway for you to learn more about your spending habits. This can also be a great way to ask for feedback on the strategies you are doing to save and if what you are doing is enough. There are many different ways to improve your money mindset, but it all starts with the decision to ask for help.For additional assistance, you can always look towards the available financial apps that allow you to access your pay early in Australia. They're an excellent solution for bridging the gap between paydays. Wagetap is one of the leading salary advance apps designed to allow you access to your wages when you need them the most.Conclusion

improving your money mindset doesn't happen overnight, but anyone can get started down the right track. The first step is knowing your current financial situation and setting realistic goals. Next, you need to identify where you are going wrong and not be afraid to ask for help. Once you understand your money mindset, you can work to improve it and make progress towards a happier financial future.App StoreGoogle PlayFor additional help, you can always download Wagetap. It is a leading wage advance and bill split app that allows you to access your pay early. Emergencies can always happen, and Wagetap can help you handle life's unexpected expenses.

For additional help in improving your spending habits, you can always download Wagetap. It is a leading wage advance and bill split app that allows you to access your pay early. Emergencies can always happen and Wagetap can help you handle life's unexpected expenses.

Share this post

Download Wagetap today

Get your Pay On demand with Wagetap

Subscribe to our Newsletter

© 2025 Wagetap All rights reserved

Digital Services Australia V Pty Ltd