FAQ

Open Banking Questions and Answers

Here are some of our most commonly asked questions about Open Banking:

Open Banking general FAQs

What is Open Banking?

Open Banking is a secure way to share your banking data with Wagetap and approve data sharing directly with your bank. It’s part of the government-regulated Consumer Data Right (CDR).

Why is this different from how I connected my bank before?

Previously, Wagetap used another secure bank connection method that allowed you to connect your bank account through your internet banking login details. With Open Banking, you no longer enter your login details in the app, instead your bank sends the data directly after you give permission. This is safer, more reliable, and controlled by you.

How do you connect to my bank?

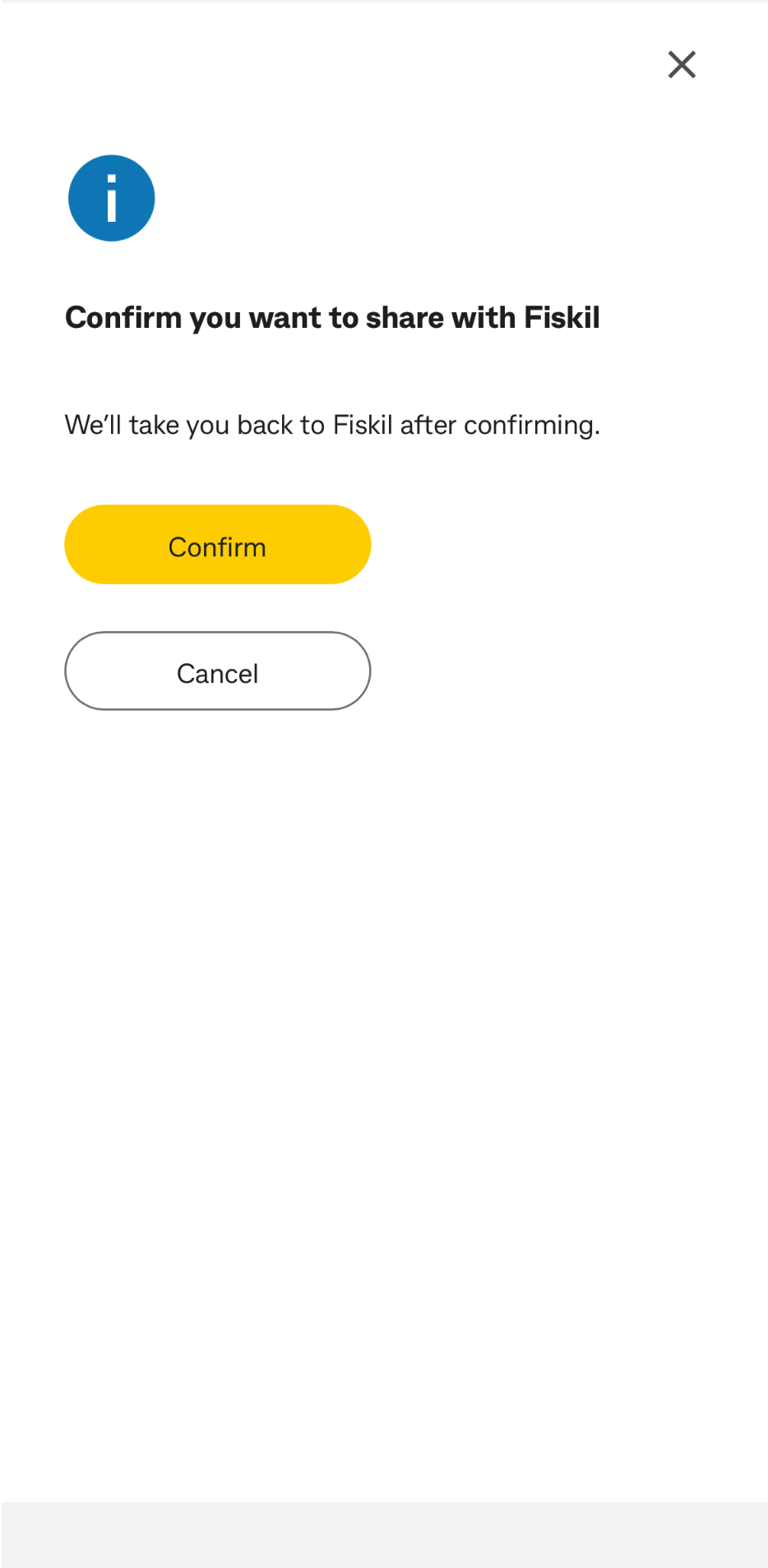

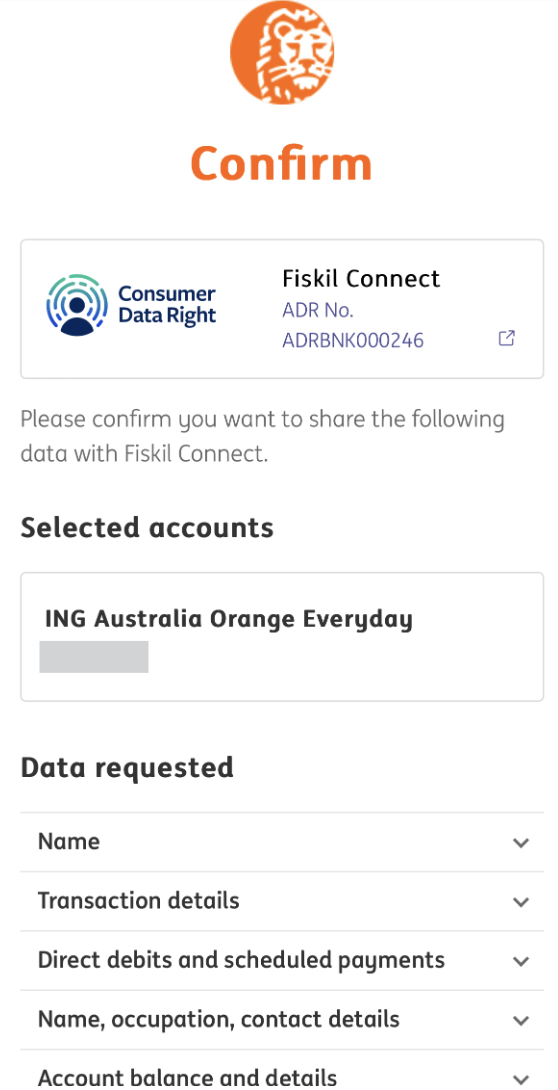

We work with our trusted provider Fiskil to access your bank data securely once you grant permission.

Is Open Banking safe?

Yes. Open Banking is regulated by the Australian Government. You control what’s shared and for how long.

Can I stop sharing my data later?

Absolutely. You can withdraw your consent anytime through our app or directly with your bank. Once you revoke access, no new data will be shared.

Will this affect my bank account or transactions?

No. Open Banking only lets the app read information you’ve agreed to share. It does not give permission to make transactions or any changes to your account.

Does it work with all banks in Australia?

Most major banks support Open Banking, and more are being added all the time. If your bank isn’t available yet, we’ll let you know and will offer another secure connection option until it’s ready.

Do I need to do anything with my bank to set it up?

Yes, but it’s quick and easy. When you connect in the Wagetap app, you’ll be redirected to your bank’s secure site or app, where you log in and approve the connection. Once that’s done, your account data flows into our app automatically.

How long does my consent last?

Consent lasts up to 12 months. Before it expires, you’ll be asked if you’d like to renew it.Consent lasts up to 12 months. Before it expires, you’ll be asked if you’d like to renew it.

What if I change my mind?

No problem, you can cancel sharing at any time.

How do I connect my bank account?

When you connect your bank account in the app, you’ll be securely redirected to your bank’s website or app. There, you simply log in and approve the connection. The process is quick and safe, though the steps may look slightly different depending on your bank. We’ve outlined the exact steps for each major bank below to guide you.

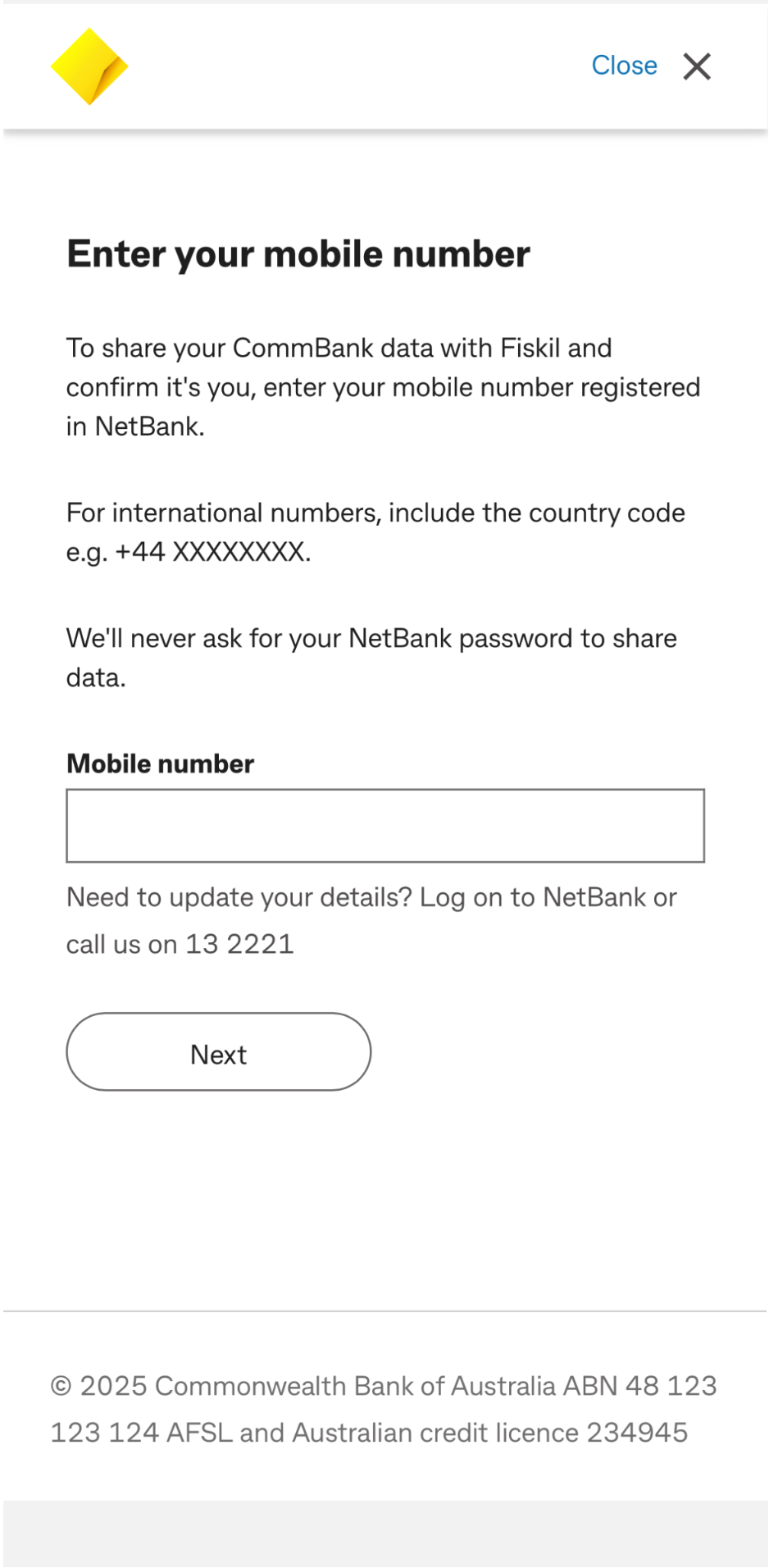

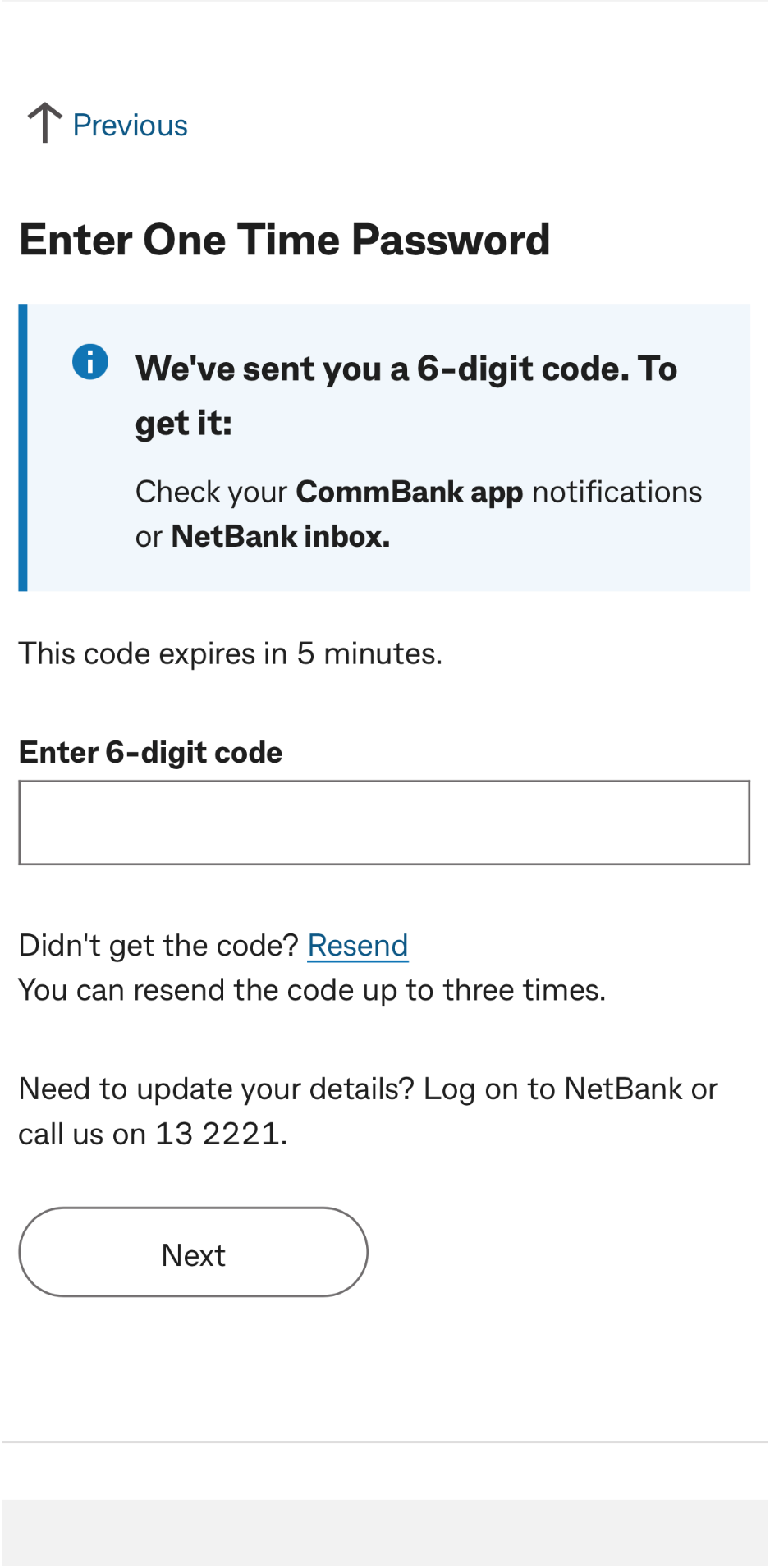

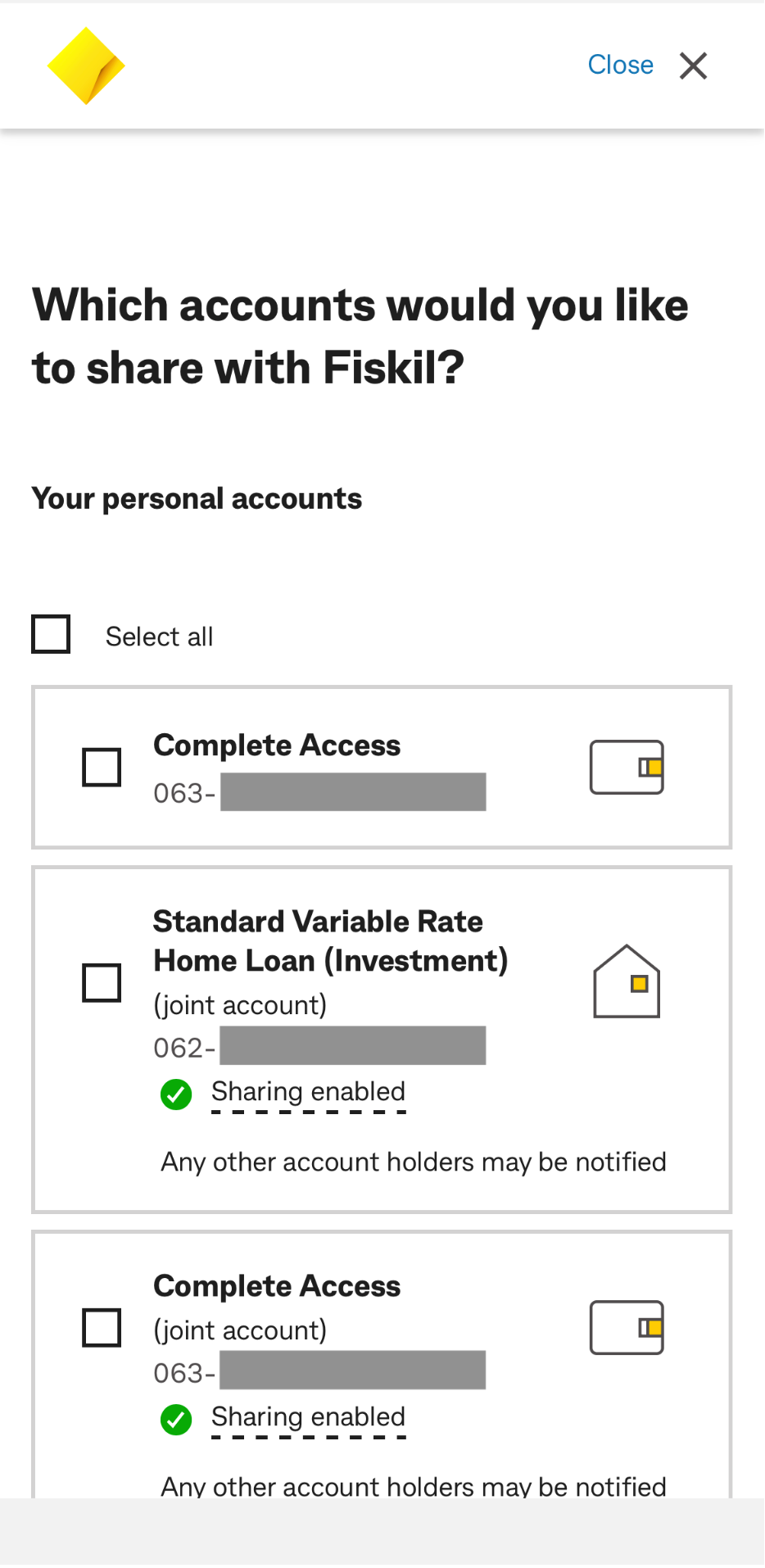

Commonwealth Bank (CBA)

1. Enter your mobile phone number.

2. You’ll receive a push notification or in-app message from CBA with a code. Enter this code in your CBA app to continue.

3. Select which accounts to share. For the best chance of approval, we recommend selecting all of your accounts.

5. Confirm that you’d like to connect using Fiskil Open Banking.

6. You’ll be redirected back to the Wagetap app to complete the connection and view your eligibility.

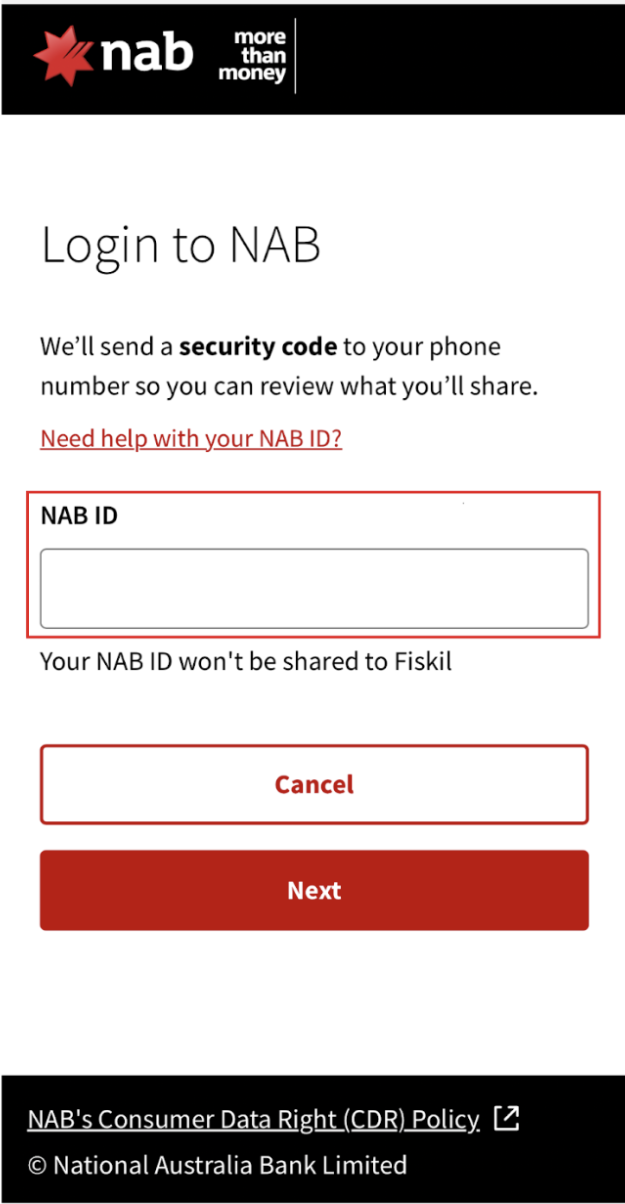

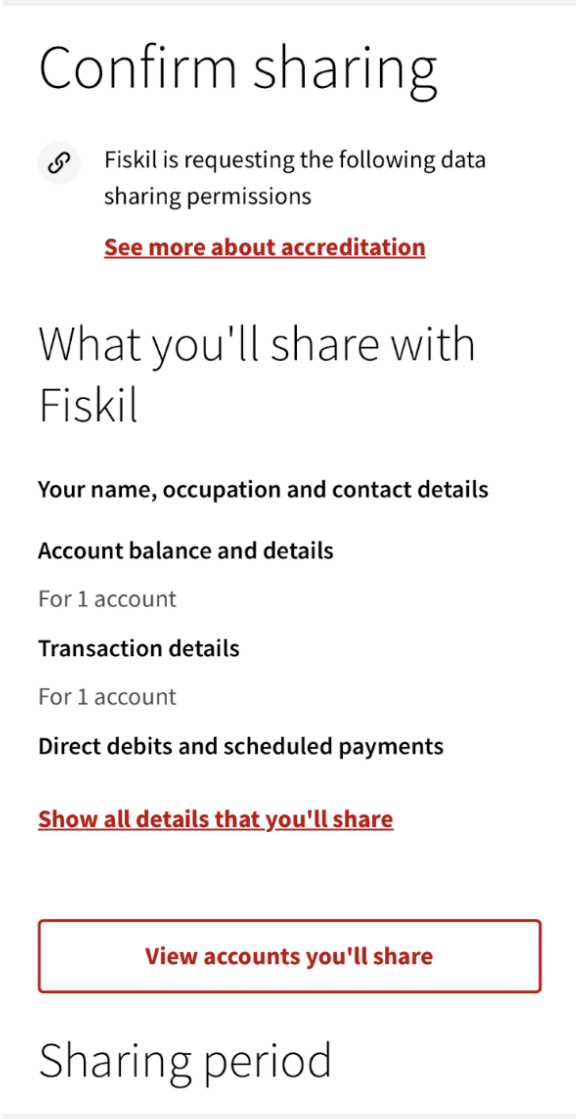

National Australia Bank (NAB)

1. Enter your NAB ID number.

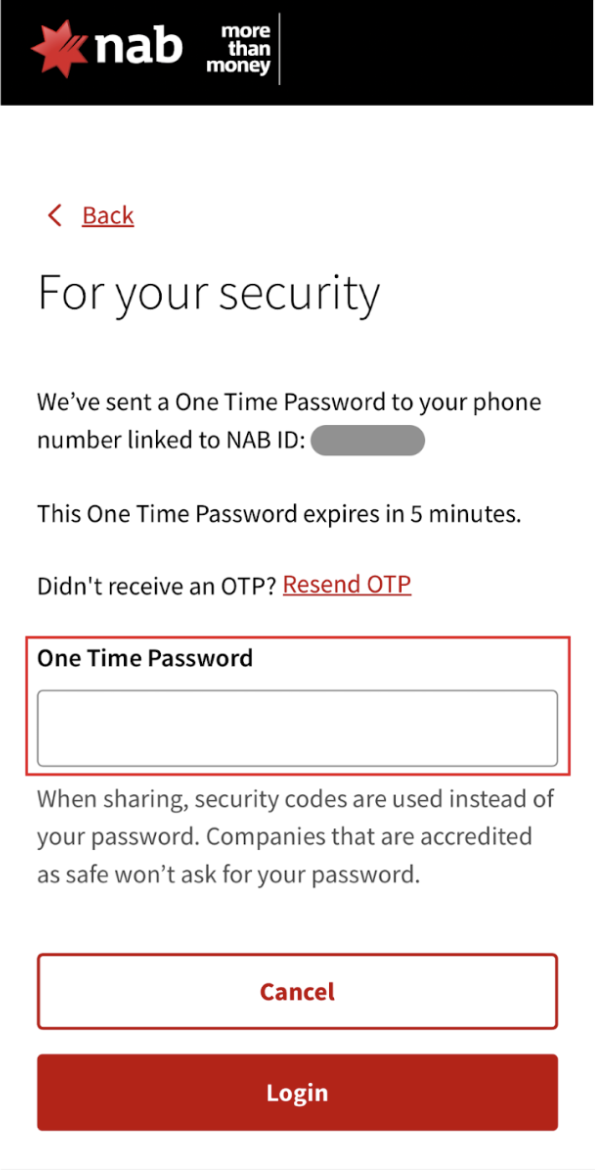

2. You’ll receive a push notification or in-app message from NAB with a code. Enter this code in your NAB app to login.

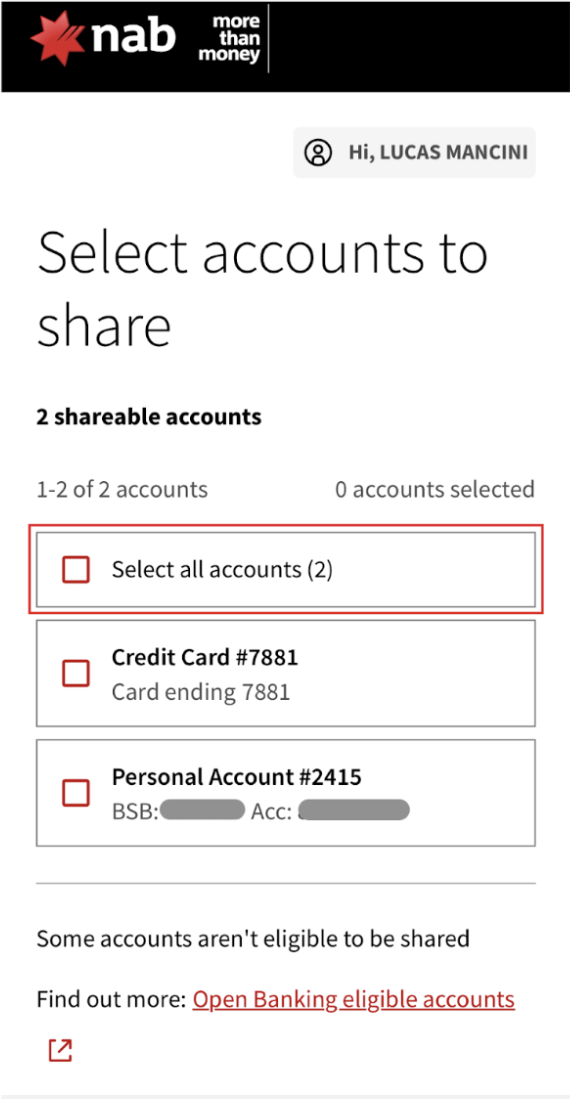

3. Select which accounts to share. For the best chance of approval, we recommend selecting all of your accounts.

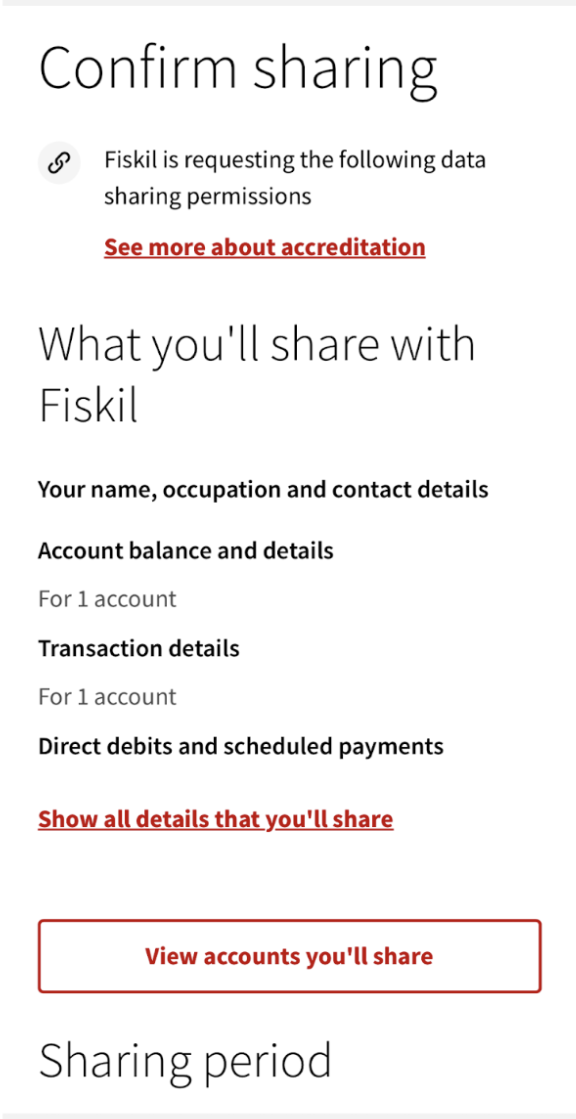

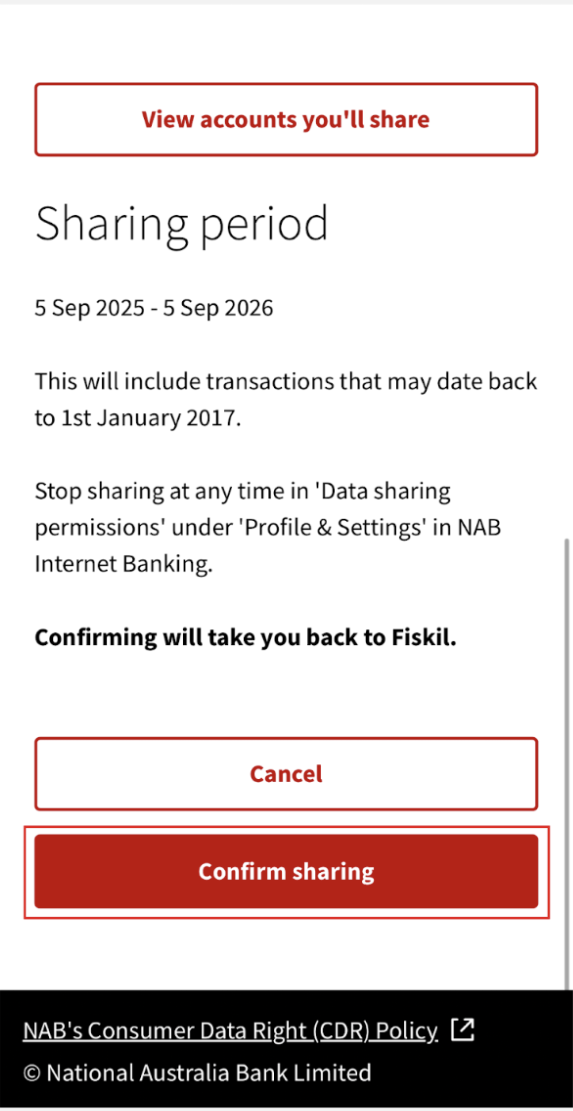

4. Check the details of the data being shared, then tap Confirm sharing.

5. You’ll be redirected back to the Wagetap app to complete the connection and view your eligibility.

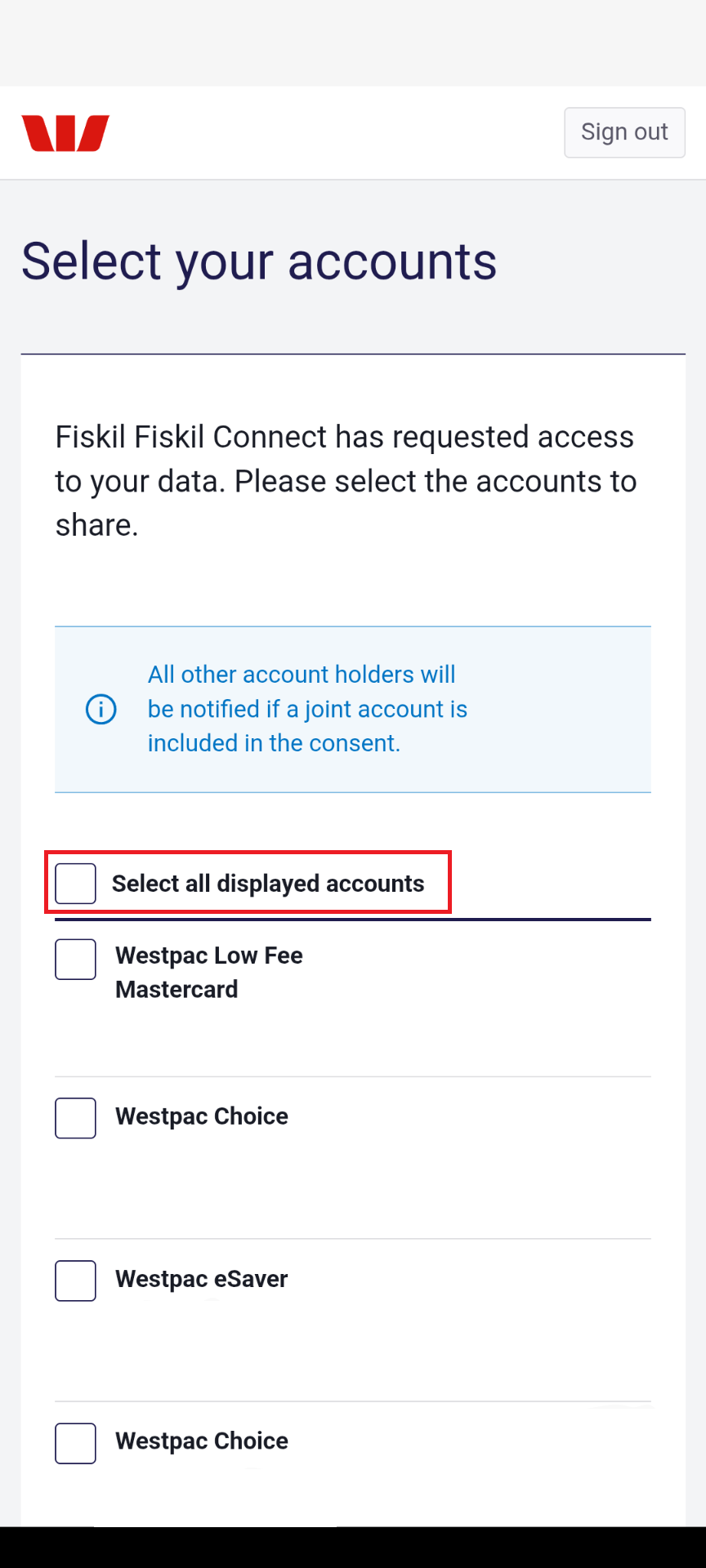

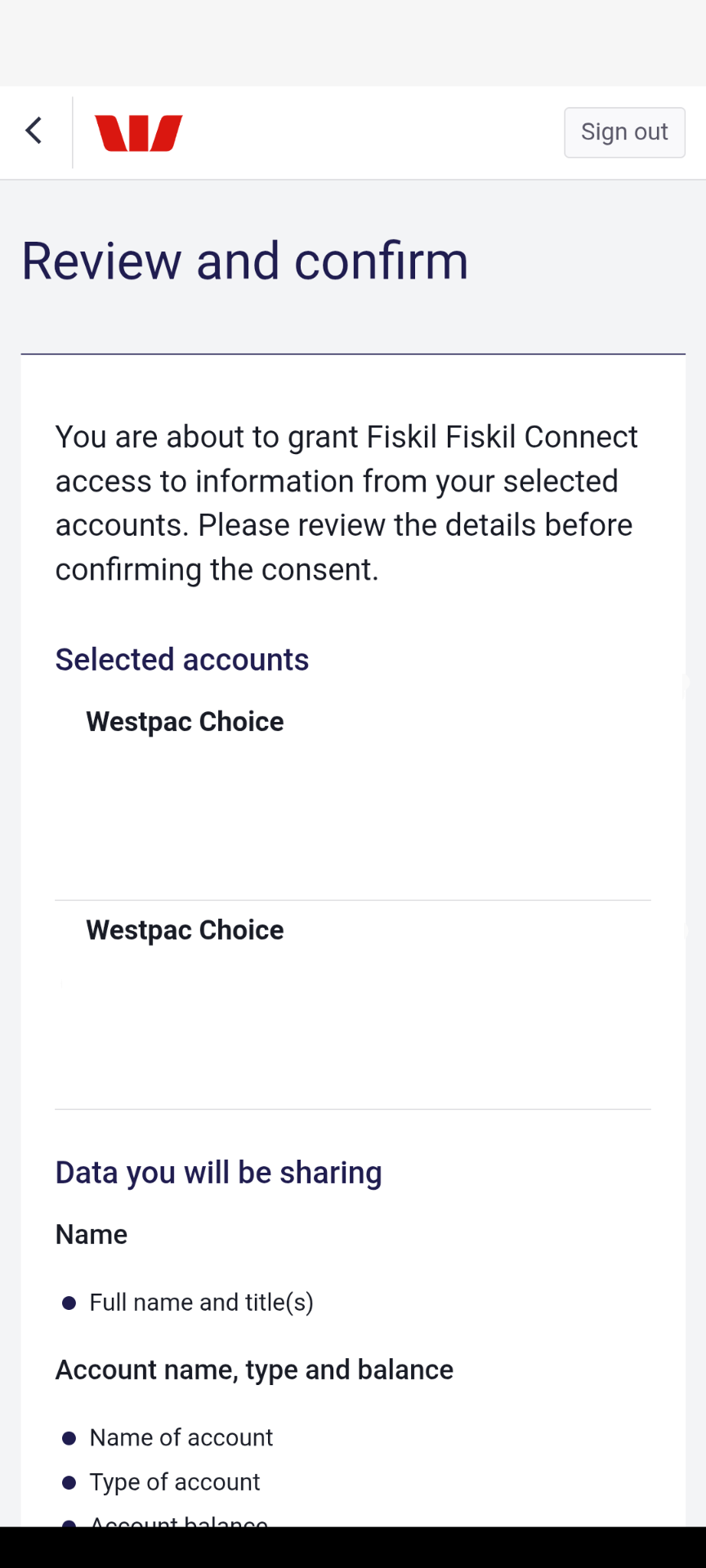

Westpac

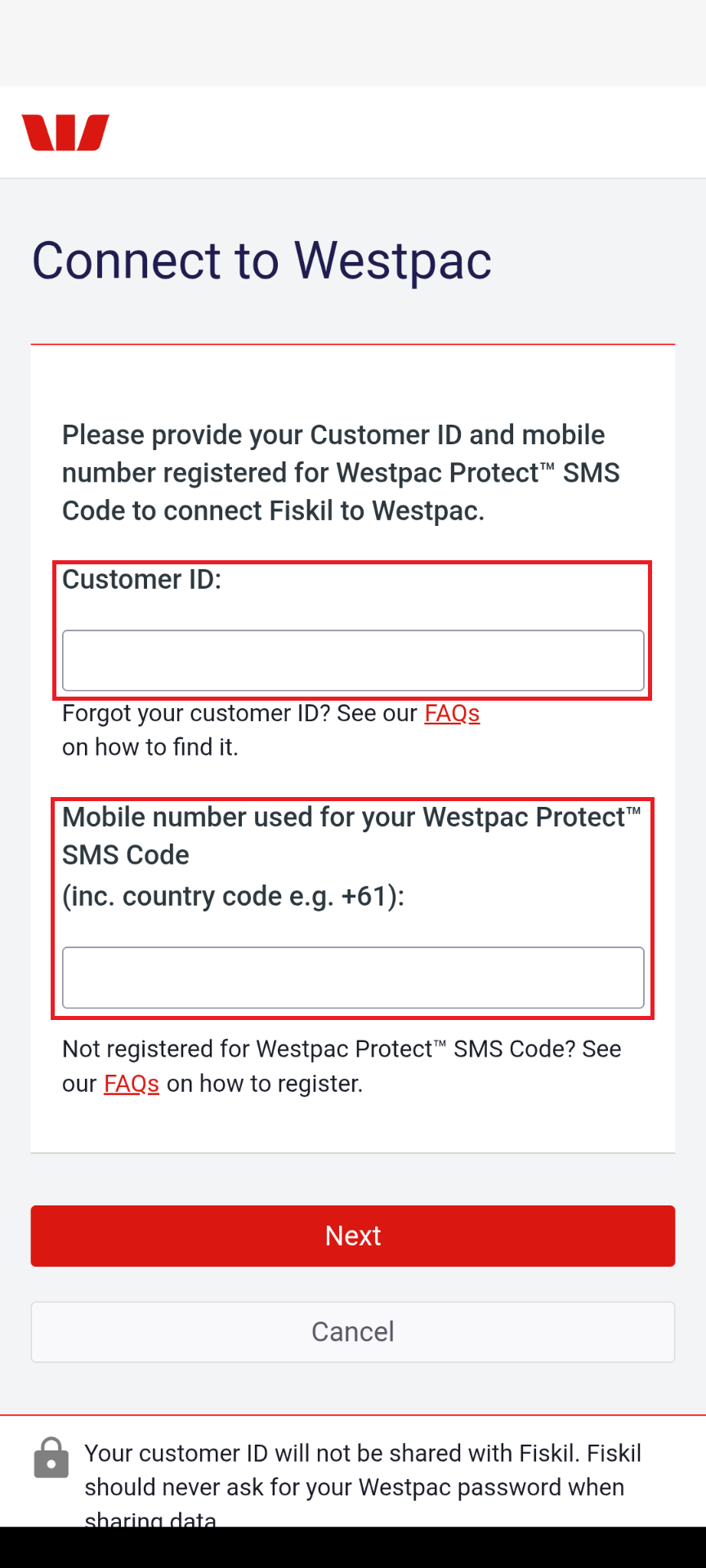

1. Enter your Westpac Customer ID and mobile number.

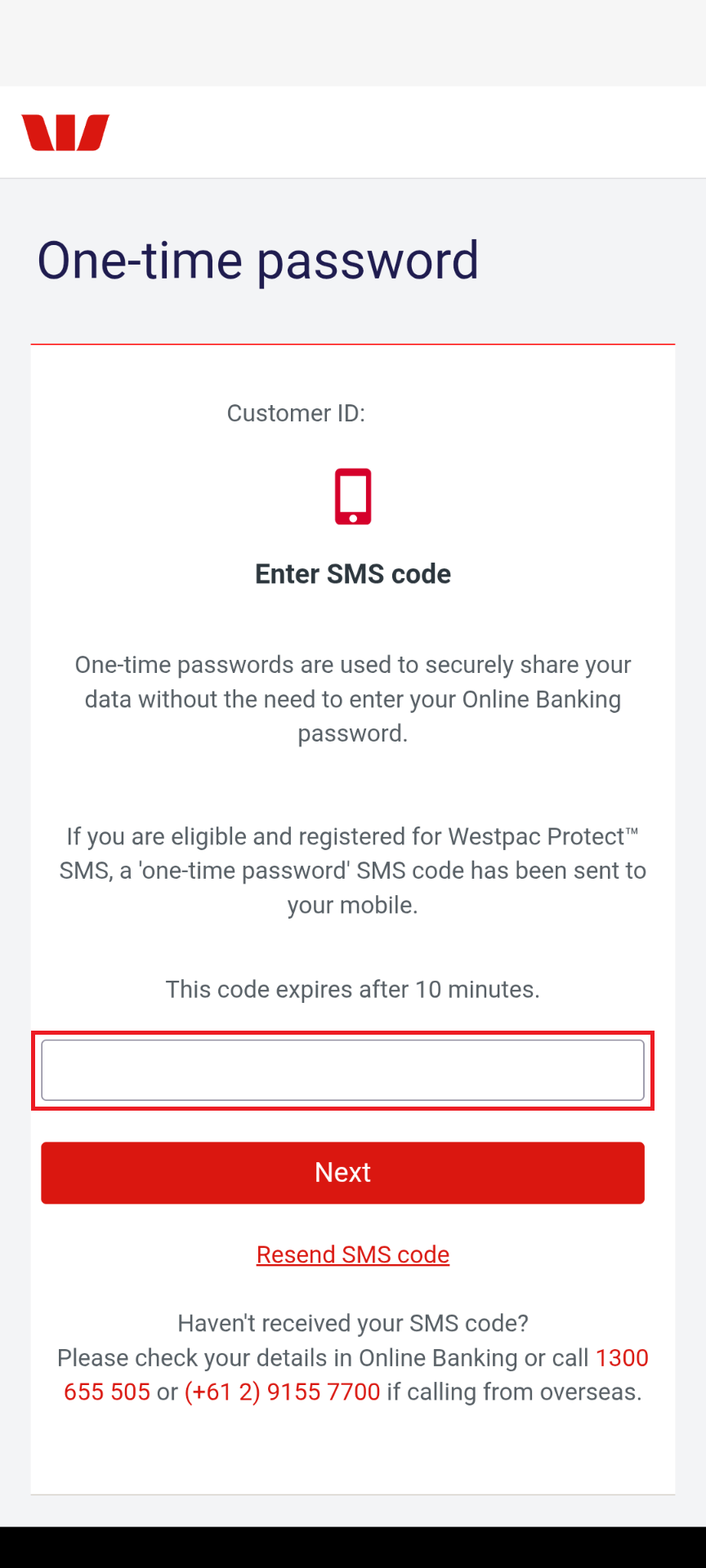

2. You’ll receive an SMS from Westpac with a code. Enter this code in your Westpac app to continue.

3. Select which accounts to share. For the best chance of approval, we recommend selecting all of your accounts.

4. Review the details, then tap Confirm.

5. You’ll be redirected back to the Wagetap app to complete the connection and view your eligibility.

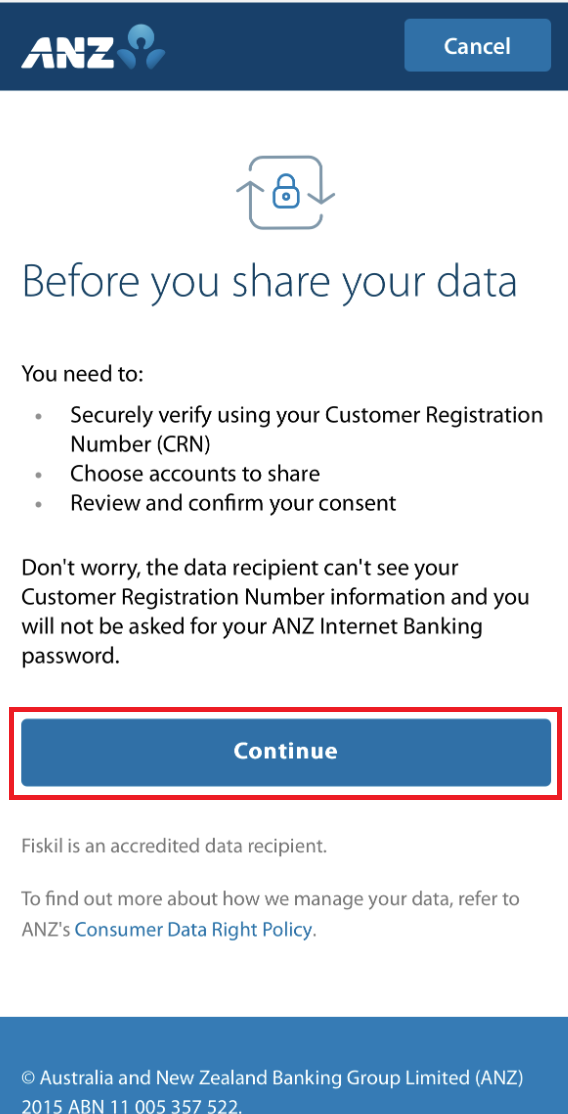

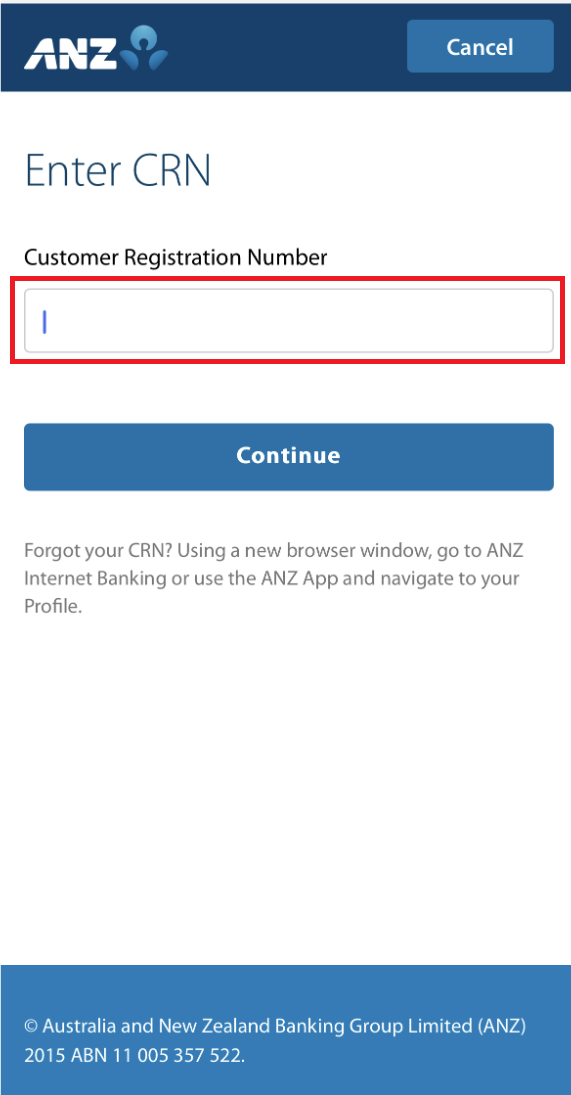

ANZ

1. Review the sharing process.

2. Enter your ANZ customer registration number (CRN).

3. Enter the verification code sent by ANZ.

4. Select which accounts to share. For the best chance of approval, we recommend selecting all of your accounts.

5. Review the details and confirm.

6. You’ll be redirected back to the Wagetap app to complete the connection and view your eligibility.

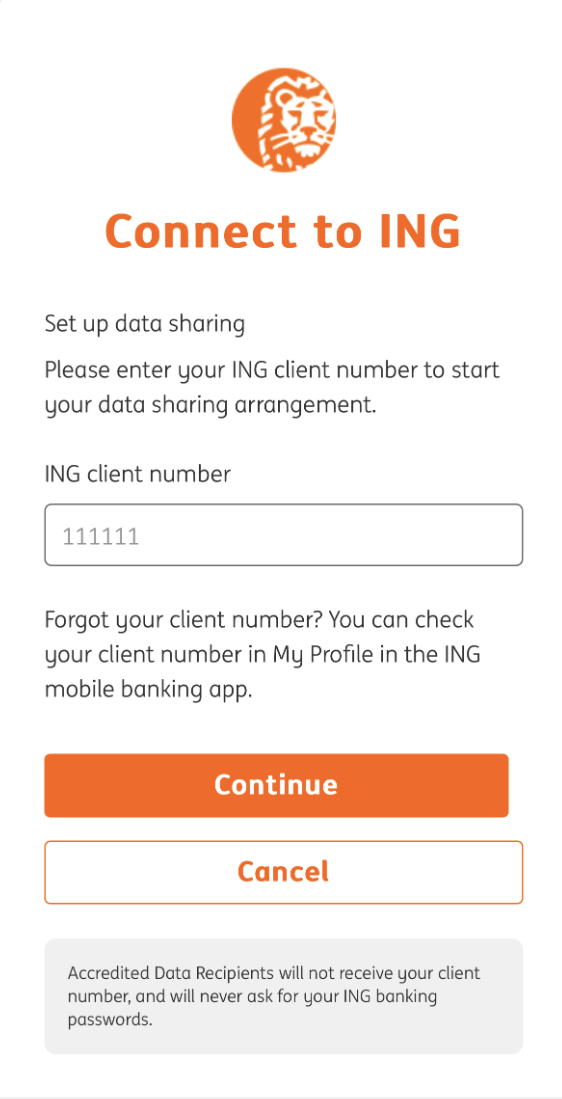

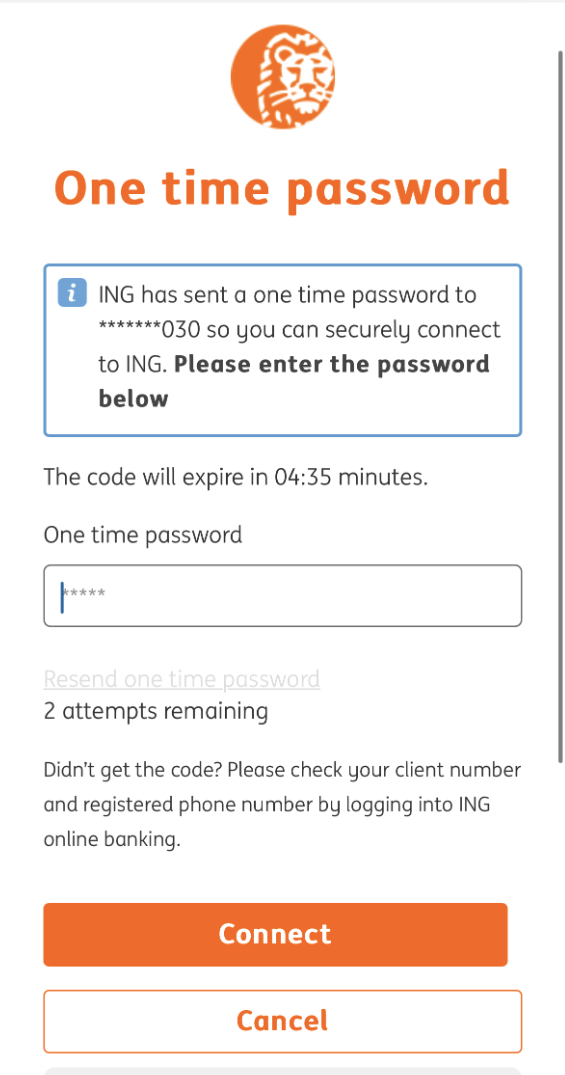

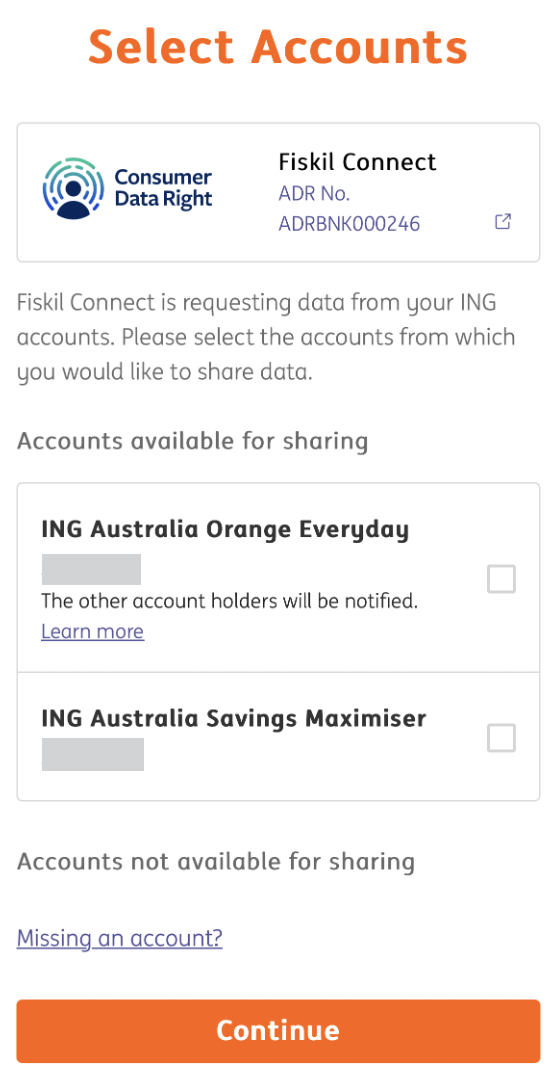

ING

1. Enter your ING client number.

2. You’ll receive an SMS from ING with a one time password. Enter this password in your ING app to continue.

3. Select which accounts to share. For the best chance of approval, we recommend selecting all of your accounts.

4. Review the details of the data being shared, then tap Confirm at the bottom of the screen.

5. You’ll be redirected back to the Wagetap app to complete the connection and view your eligibility.

Download Wagetap today

Get your Pay On demand with Wagetap

Subscribe to our Newsletter

© 2026 Wagetap All rights reserved

Digital Services Australia V Pty Ltd