Financial Habits of People Who Always Have “Just Enough”

Always feel like you're running low on cash? Learn the simple money habits of people who always have just enough—and how tools like wage advance apps can help you stay ahead.

Financial Habits of People Who Consistently Make Ends Meet

You know the kind. They're not wealthy, but they never appear to worry about money. They're not indulging in excessive luxuries, but their bills are always up to date, their fridge is stocked, and they even pay for the occasional weekend getaway or spontaneous coffee stop. How do they manage it?It appears, it turns out, that individuals who always seem to have "just enough" have a few consistent financial habits. They're not about extremes or perfection—just smart, consistent steps that keep things humming along.They Know Exactly What Comes In and Goes Out

Individuals who are prudent with their finances tend to have a fairly clear idea of how much they make and what happens to it. They're not estimating how much money is in their account—they've already checked.It doesn't imply that they monitor every cent in an Excel spreadsheet (although some do), but they have a general sense. Whether it's looking at their balance every few days or using a budgeting app, they remain attuned to their finances rather than flying by the seat of their pants.They Keep Their Lifestyle in Check

They're Selectively Frugal

Those with barely enough money are not cheap on everything. They understand when to spend and when to cut back. Perhaps they make most meals at home but indulge in decent shoes because they'll survive longer. Or they'll forego the everyday coffee shop ritual but pay for a good espresso machine at home.It's about prioritising value rather than volume. They scale back in those areas that are less important to them and spend in those places where it truly will count.They Expect the Unexpected

They Avoid Financial Clutter

People who always seem to have enough tend to keep things simple. They aren’t juggling five credit cards, dozens of subscriptions, and multiple loans. Fewer accounts mean fewer chances for fees, missed payments, or forgotten auto-renewals.They also take care to go through their accounts every now and then, cancelling those they don't use, and merging where feasible. Simpler money systems are less complicated—and more difficult to fudge.They Use Tools That Work for Them, Not Against Them (Like Wage Advance)

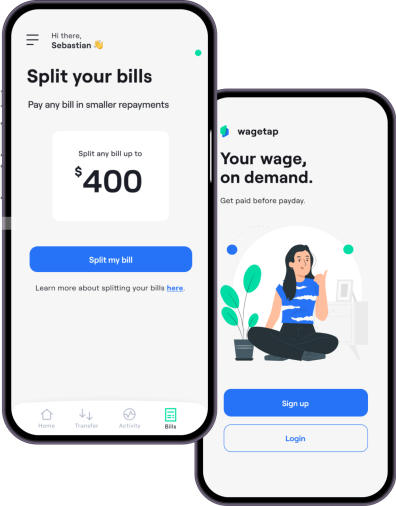

For additional help in improving your spending habits, you can always download Wagetap. It is a leading wage advance and bill split app that allows you to access your pay early. Emergencies can always happen and Wagetap can help you handle life's unexpected expenses.

Share this post

Download Wagetap today

Get your Pay On demand with Wagetap

Subscribe to our Newsletter

© 2026 Wagetap All rights reserved

Digital Services Australia V Pty Ltd