7 Ways to Cut Expenses Now - How To Save Money Now

You know that feeling when your bank statement comes, and you see all those red numbers? That sinking feeling in your stomach is when you realise you’re short on cash. If you find yourself in this situation often, you need to find ways to cut expenses and live with a smaller budget. The key is identifying areas where you can reduce spending without impacting your lifestyle.

Here are 7 Ways to Cut Expenses Now

1. Change Your Mindset

The first thing you need to do to cut your spending is to change your mindset about money. Instead of always thinking about how much you have (or don’t have), think about how much you can make. Be creative, and look for opportunities to earn more.For example, you could start blogging, delivering groceries, renting out a room in your house, or doing freelance work, to name a few. Also, think about where your money goes each month and why. Once you have the proper mindset, you can start finding ways to cut expenses and save money without depriving yourself.2. Review Your Spending Habits

Spending less than you earn is the simplest way to get out of debt and build savings. However, changing your habits and sticking to a strict budget requires diligence and commitment.Start by making a list of all your recurring expenses. Include everything from utility bills to your car insurance, groceries, internet service, and more. Then, cross-reference the list against your bank statement from last month. Now you have a better idea of where most of your money is going.Next, categorise each expense based on whether it’s necessary or not. This will help you determine where to start cutting expenses now and save money. Some expenses are necessary because they provide utility, while others are unnecessary because they don’t. For example, your car payment is a necessary expense because it’s a commitment you made when you drove off the lot in your new car.3. Cancel Subscriptions You Do Not Use

4. Slash the Food Budget

Eating out is one of the most significant expenses people have. It’s also easy to cut, and you can save money on your budget. Start by identifying which restaurants you visit the most, then plan how to visit them less frequently. Instead of eating out, try hosting friends and family at your place. Or, invite them over for a potluck, where everyone brings a dish to share. Another way to slash your food budget is to shop smarter. Buy in bulk and make large portions so you can freeze the leftovers. You can also grow some of your vegetables, which are cheaper and healthier than those you buy at the store. One of the benefits of doing these things is being healthier with your choice of foods. Eating out usually entails less favourable options not only for your budget but also for your body. You can track your nutrition intake if you practice preparing food at home.5. Dining Out – Go Takeaway Instead!

6. Repairs and Maintenance

Some things, like your car and roof, need repairs and maintenance no matter what. This is a necessary expense, but it can consume a big chunk of your budget if you don’t pay attention to every detail. One way to cut expenses and save money is to get a maintenance contract for essential items.For example, you can get a contract for your car’s oil changes and tune-ups with a fixed price and a guaranteed completion date. You can also hire a trusted roofing company to maintain and repair your roof. This way, you can avoid paying for repairs out of your pocket.Another way to cut expenses and save money is to do basic repairs yourself. You can learn how to change your car’s oil, replace your air filter, and even repair small holes in your roof. This way, you can avoid paying mechanic and roofing contractor fees and put the money you save towards your savings.7. Get Rid of Things You Do Not Need Anymore

Conclusion

Cutting expenses right at this moment and saving money will enable you to get out of debt, build savings, and start investing. Remember that eliminating unnecessary expenses is not the end goal but a step towards financial freedom and success. Having this in mind can help you stay motivated, look at the bigger picture, and see what's ahead.Download Wagetap to Help with Your Financial Journey!

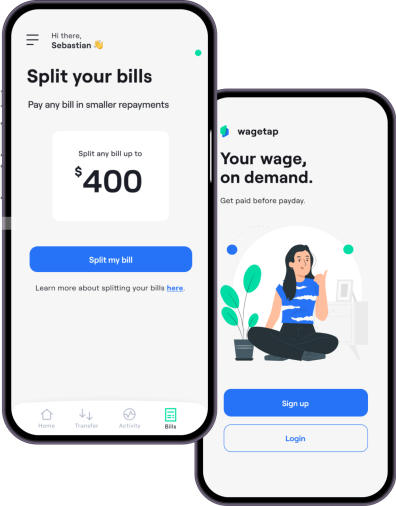

The available financial apps on the market can also help with your expenses. Pay-on-demand apps are rising, and Wagetap is one of Australia's leading salary advance apps.App StoreGoogle PlayYou can download the app and sign up for a free account to get early access to your pay now. Emergencies can always happen, and Wagetap can help you handle life's unexpected expenses.For additional help in improving your spending habits, you can always download Wagetap. It is a leading wage advance and bill split app that allows you to access your pay early. Emergencies can always happen and Wagetap can help you handle life's unexpected expenses.

Share this post

Download Wagetap today

Get your Pay On demand with Wagetap

Subscribe to our Newsletter

© 2024 Wagetap All rights reserved

Digital Services Australia V Pty Ltd