5 Simple Ways To Achieve Financial Freedom

Financial freedom is something that many people strive for. It’s the feeling of being ready to take on the world at any moment without worrying about money being a constraint. Financial freedom means covering your expenses so that you can quit your job if you want to and not have to worry about how you will pay your bills or other financial obligations. Whether you are renting an apartment, living with parents or partners, or living in a dormitory, budgeting plays a significant role in achieving financial freedom. This could be the time to get out of that financial rut and start saving money for the future.

Here are 5 Simple Ways to Achieve Financial Freedom

Pay Yourself First

The first step to financial freedom is to pay yourself first. This means that before you do anything else, you need to make sure that you are financially secure. A good way to do this is to increase your monthly investments. Start investing a portion of your income that you would otherwise be spending. This way, you will have the money you need in the future when you may need it the most.While saving is important, you also should not forget about having fun Investing is essential if you want to achieve financial freedom, but you also need to enjoy and feel the fruits of your labour. As you get older, it will be harder and harder to make the money that you are making now. So make the most of your youth and enjoy it.Track Your Spending

Saving money is essential and will help you achieve financial freedom. You need to track your spending and make sure that you are not overspending. There are many different apps and online platforms that can help you keep track of your spending, such as…. They will help you identify where you can cut back on spending so that you can save more money.While tracking your spending might seem like a chore, it can also be quite fun as you can also look at your purchases and see where your money goes. If you get to know your spending, you can also identify areas where you can start saving money.For instance, you might want to save money on your internet bill by switching to a cheaper internet service provider. Another example is you might want to start saving money by buying a cheaper car.Invest the Surplus

You have to ensure you are investing the surplus of your income. This is the best way to start investing and achieving financial freedom. There are many different investment options out there that you can choose from. You can start investing in stocks, bonds, mutual funds, real estate, etc.The great thing about investing is that you don’t have to start with much money. You can start investing with as little as $50 or $100. The earlier you start investing, the more time your money will have to grow. Start investing as soon as possible and ensure you do not stop until you achieve your financial freedom.Automate Your Investment

Another way to achieve financial freedom is by automating your investing. This means you will invest a specific amount of money each month into the investment of your choice. For example, if you invest in a mutual fund, you will invest a specific amount each month.You can also automate your investing by investing a specific amount of money each time you get paid. This is a great way to invest, as you will not have to worry about investing a large amount of money or trying to remember to invest.When you automate your investing, you make sure you invest a specific amount of money each month and don’t have to worry about anything else. After a few months, you will save significant money and be one step closer to achieving financial freedom.According to Forbes Advisor, some of Australia’s leading automated investment apps that you can look at are CommSec Pocket, Pearler Micro, Spaceship Voyager, and Sharesies.Re-evaluate Your Expenses

Another important way to achieve financial freedom is by re-evaluating your expenses. You need to ensure you are not spending your money on unnecessary things. If you are spending too much on your rent, start looking for a cheaper apartment or a roommate. If you are spending too much on food, try eating at home more often.You can start saving money and re-evaluating your expenses in many different ways. Once you have started saving money and adding that additional buck to your bank account, you will be one step closer to achieving financial freedom.What this means for you

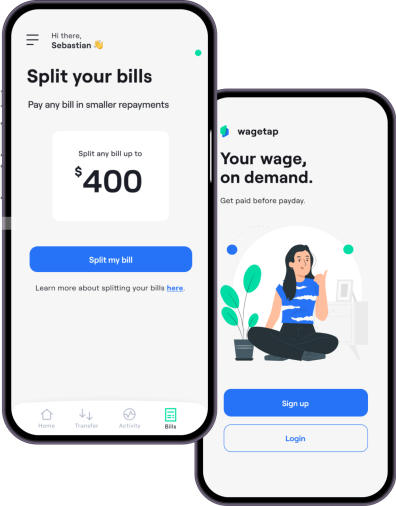

The best way to achieve financial freedom is to start saving as much money as you can as early as you can. The sooner you start saving, the more time your money will have to grow and the closer you will be to achieving financial freedom.App StoreGoogle PlayAnother good way to manage your money is to ensure emergency funds are ready for any unexpected expenses. You can look into cash advance apps like Wagetap if you still haven't saved enough. It is one of Australia's leading pay advance apps that allows you to access your pay early for any financial emergencies.For additional help in improving your spending habits, you can always download Wagetap. It is a leading wage advance and bill split app that allows you to access your pay early. Emergencies can always happen and Wagetap can help you handle life's unexpected expenses.

Share this post

Download Wagetap today

Get your Pay On demand with Wagetap

Subscribe to our Newsletter

© 2024 Wagetap All rights reserved

Digital Services Australia V Pty Ltd